- The Fraudfather's Dead Drop

- Posts

- 3 Doors, 2 Goats and 1 Middle-Class Crisis

3 Doors, 2 Goats and 1 Middle-Class Crisis

The Monty Hall Paradox, Marilyn vos Savant’s public crucifixion, and the everyday math hacks that keep you from herding goats for the rest of your life.

The Monty Hall Paradox, Marilyn vos Savant’s public crucifixion, and the everyday math hacks that keep you from herding goats for the rest of your life.

GM, Welcome Back to the Dead Drop.

Fraud rings, click-bait option trades, and “guaranteed” 17% staking yields all rely on the same cognitive loophole that torched America’s top minds in 1990. If you don’t see how the scammer is playing Monty Hall while you’re busy feeling smart, you are the prize goat.

THE PUZZLE THAT PUNCHED A HOLE IN OUR COLLECTIVE EGOS

September 9, 1990. Parade magazine lands on 26 million doormats. In the back pages sits “Ask Marilyn,” a column run by Marilyn Mach vos Savant, Missouri bar-owner’s daughter, Guinness-certified highest IQ on Earth (228). A reader’s challenge appears:

“Suppose you’re on a game show: three doors, one hides a car, two hide goats. You pick Door #1. Monty Hall, who knows what’s behind the doors, opens Door #3 and reveals a goat. He says, ‘Want to stick with #1 or switch to #2?’ What should you do to maximize your odds?”

Marilyn’s print-ink reply: “Switch. The probability of winning rises from 1/3 to 2/3”

THE HATE MAIL DELUGE

10,490 letters flood Parade’s Manhattan office in three weeks.

PhD physicists accuse her of “elementary blunders.”

One MIT professor suggests she “go back to sewing.”

A Nobel laureate labels her answer “intellectual fraud.”

All for defending sixth-grade conditional probability. Why? Because the puzzle looks like a coin flip after Monty opens a door, but only if you ignore everything that happened before he moved.

WHY THE 2⁄3 ANSWER IS BULLETPROOF

Stage | Car Odds (Door #1) | Goat Odds (Other Doors) |

|---|---|---|

Initial Pick | 1/3 | 2/3 (spread across #2 & #3) |

Monty reveals goat at Door #3 | 1/3 (Unchanged ) | Entire 2/3 collapses onto Door #2 |

Monty must avoid the car; he never opens it by accident. His action gives you information. Your original 1/3 stake stays on Door #1; the entire 2/3 “goat pile,” the odds you were wrong, moves wholesale to the only other closed door. That’s it. No calculus, no voodoo.

THE PSYCHOLOGY OF WHY WE STILL SCREW THIS UP

Mental Reflex | What Your Brain Whispers |

|---|---|

Symmetry Bias | “Two doors left = 50/50.” |

Sunk-Cost Pride | “Switching means I was dumb.” |

Host Blindness | “The game is random” |

These reflexes beat formal education, credentials, and IQ. Even pros tank if they update feelings instead of fractions.

HOW SCHOOL MASS-PRODUCES GOAT HERDERS

SLOT A: ROTE MEMORIZATION

What happens: Formulas taught as magic spells. Context stripped.

Consequence: Students know Pascal’s triangle, not when to ask Pascal’s questions.

SLOT B: MULTIPLE-CHOICE WARFARE

Design flaw: Eliminate one obviously wrong answer, then treat the rest as equal contenders.

Monty Hall link: Feels natural to equate remaining options even when data screams otherwise.

SLOT C: SPEED-FIRST TESTING

Timed exams reward the fastest regurgitator, not the deliberate updater. Real-world fraud rewards the patient recalculator.

SLOT D: SUBJECT SILOS

Probability lives in math class, critical thinking (maybe) in English, incentives in economics—never stitched together. Scammers prey on interdisciplinary blind spots.

FIELD MANUAL: SIX DAILY HACKS TO “MONTY-PROOF” YOUR LIFE

THE 1-2-3 DOOR COUNT (30 SECONDS)

Whenever you face a decision:

List every live option.

Identify which ones new information has definitively killed.

Shift your mental odds to the survivors before reacting.

Do it for emails, stock entries, even weekend plans. Muscle memory beats IQ.

THE “FRESH-START” RESET

Ask: “If I were starting fresh right now, which door would I pick?”

If the answer differs from your current choice, pride, not math, is at the wheel.

TWO-MINUTE PAUSE BUTTON

Practiced by chess grandmasters and bomb techs alike:

New info arrives ➜ Start a 120-second timer.

During pause ➜ Re-score the odds, jot one sentence on why.

Decision follows the buzzer.

This tiny ritual neutralizes urgency traps built into phishing pages and FOMO tweets.

GOAT-REVEAL QUESTIONS

Force the “host” to expose something safe first.

“Show your worst monthly churn.”

“Walk me through your biggest refund pain.”

“What hasn’t gone according to plan so far?”

If they won’t crack a door, assume the car is already stripped for parts.

POCKET ODDS JOURNAL

Carry a tiny notebook (or phone note) and:

Assign a % to everyday assumptions (“Gym will be empty at 6 a.m.- 60%”).

Revise when new signals land (“Parking lot full—drop to 20 %”).

Review weekly to see how often your first odds needed heavy surgery.

You’re literally weight-training your probability muscle.

CROSS-POLLINATION SUNDAY

Spend 15 minutes reading outside your domain: magician misdirection tricks, poker hand histories, wartime deception ops. Write one sentence connecting that tactic to your day job. The brain cements concepts when they appear in multiple costumes.

MONTY’S MODERN STAGE

Old School Stage Prop | 2025 Upgrade | Your Counter-Move |

|---|---|---|

Game Show Host | Algorithm recommending “just two” alt-coins | Apply Door Count; banish FOMO. |

Shiny Car | Six-figure yield farm “backed” by TVL | Goat-Reveal: ask for audited code, verifiable burn address. |

Audience Applause | Social-media bot swarm echoing “to the moon” | Pause Button; re-score odds after noise filtered. |

Carnival Music | Telegram group countdown timers | Fresh-Start Reset. Would you join if timer read 30 days? |

CURTAIN CLOSE: DRIVE AWAY OR GRAZE

Marilyn vos Savant didn’t invent a trick; she exposed one. Three decades later, AI voice clones, deep-fake audits, and DAO rug-pulls all wield the Monty lever: they curate what you see so you’ll mis-price what you don’t.

Car winners:

Update odds when evidence changes.

Kill sunk-cost ego on sight.

Interrogate the host’s incentives.

Goat keepers:

Equate “two options” with “equal odds.”

Confuse confidence with calibration.

Outsource thinking to speed, pride, and group chat hype.

The hallway hasn’t changed, only the wallpaper. Step back, recount the doors, and make the switch when the math tells you to. Your bankroll, your vote, and your sanity are parked behind one of them.

Welcome to the Dead Drop. Pick like a strategist, not livestock.

“People try to live within their income so they can afford to pay taxes to a government that can’t live within its income”

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

Imagine waking up tomorrow to find your neighborhood divided by an invisible velvet rope.

Left side of the rope: brand-new EVs charging in the driveway, Peloton deliveries piling up by the porch, kids gliding through private-tutor Zoom rooms.

Right side: rent checks floated on 22% APR cards, “side hustles” stacked like Jenga blocks, inboxes jammed with Buy-Now-Pay-Later notices.

No police barricades. No protest signs. Yet the separation is absolute.

Most of us feel that fracture in dozens of small aches, grocery bills sprint ahead of raises, the starter home escapes by six more zip codes, every “recovery” seems to skip our own. What we don’t see is the machinery (the fraud) that widens the gap, day after day, crisis after crisis. It’s buried in spreadsheets we never open and acronyms no one bothers to translate.

This piece lifts the tarp. You’ll watch brand-new dollars travel from a single Fed keystroke to a 45-floor trading desk, and learn why only loose change trickles to Main Street months later. We’ll staple (Fed) FRED receipts to every claim, M2 lines that rise like Everest, consumer-credit charts that flip into ski slopes, and a Fed balance sheet with its own ZIP code. Then we’ll revive an 18th-century economist, Richard Cantillon, to show how the money cannon always fires at Wall Street’s door first—and how a mild uptick in grocery prices morphs into a life-altering wealth transfer.

Stay with me.

By the end you’ll know exactly why the middle class is dissolving into a barbell of asset owners vs. debt serfs, and you’ll walk away with a blueprint to keep yourself on the heavy end—before the next trillion-dollar “rescue” pumps out what it really is: pre-inflation for the rich.

“…wealth accumulated in the past grows more rapidly than output and wages. This inequality expresses a fundamental logical contradiction. The entrepreneur inevitably tends to become a rentier, more and more dominant over those who own nothing but their labor. Once constituted, capital reproduces itself faster than output increases. The past devours the future.”

THE VANISHING CENTER

Year | Share of U.S. Adults in Middle Income Households |

|---|---|

1971 | 61% |

2023 | ~51% |

Every new data point nudges the line lower. Our bell-curve society is morphing into a barbell: asset-heavy “haves” on one side, debt-laden “have-nots” on the other.

THE THREE ENGINES STRETCHING THE GAP

Wages vs. Costs

Housing, healthcare, tuition, and taxes sprint while paychecks jog. Disposable income compresses—even in boom years.

Job Polarization

Globalization has shipped 5.8 million factory jobs overseas since 2000. Now AI stalks the cubicles offshoring left behind, automating routine white-collar work.

Inflation as Policy

When Washington prints money, the first stop is Wall Street, not your paycheck. Assets levitate long before wages notice.

THE CANTILLON EFFECT: MONEY’S FIRST-MOVER ADVANTAGE

Injection Point → Primary dealers, mega-banks, Treasury auctions.

Asset Inflation → Stocks, bonds, real estate spike before cereal and rent do.

Cost Catch-Up → Late receivers (salary earners) finally get new dollars—after price tags rise.

Permanent Spread → Early receivers already owned the inflating assets; late receivers just pay the higher bills.

Translation: each Quantitative Easing dollar is a Ferrari in Manhattan on Day 1 and a beat-up rental by the time it reaches Main Street.

RECEIPTS: FRED CHARTS THAT SCREAM

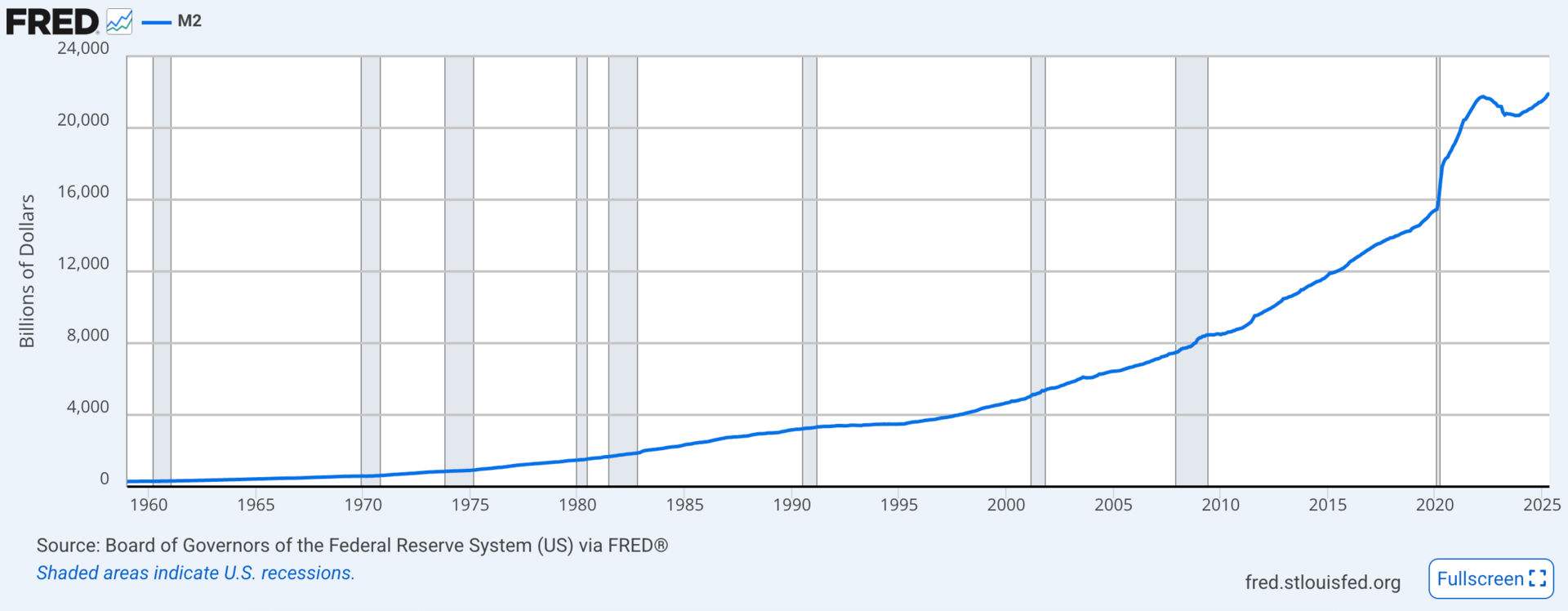

M2 Money Supply: The total of cash in circulation plus everyday bank money—checking, savings, money-market funds, and small CDs. Basically all dollars households can tap without selling investments.

Six decades of gentle slope end in a vertical wall. After 2020 the Fed injected more new dollars in 18 months than in the previous 40 years combined, proof that when trouble hits, the printer goes from drip to fire-hose.

Fed Balance Sheet: One emergency spike in 2008, a steady swell through the 2010s, then a vertical liftoff in 2020 to nearly $9 trillion, proving the central bank’s go-to rescue play is “buy everything and ask questions later.”

Every time that blue line jumps, the Fed is pumping fresh dollars into Wall Street, propping up stocks and real estate first. The result: asset owners ride another rocket, everyday prices follow, and the middle class falls one rung lower on the ladder.

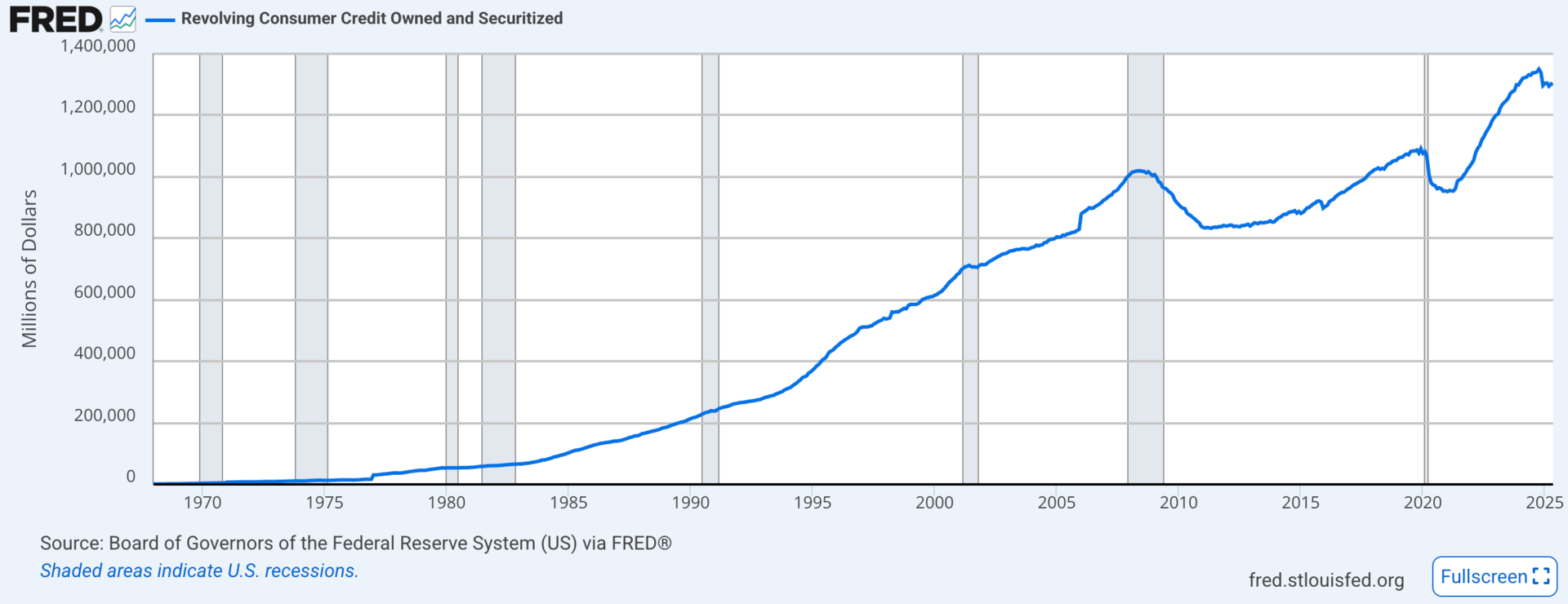

Revolving Consumer Credit: A four-decade climb pauses briefly in 2020, then rockets to an all-time high above $1.3 trillion. Americans are leaning on credit cards harder than ever.

When everyday living costs outpace wages, the middle class swipes plastic at 20 % interest just to tread water, turning short-term convenience into a long-term wealth drain.

Credit Card Interest Rates: After drifting near 12% for a decade, average card APRs blast past 21 % in 2024; the highest in the series.

Any balance you carry now compounds like payday-loan debt, turning everyday convenience into a wealth vacuum for the already-squeezed middle class.

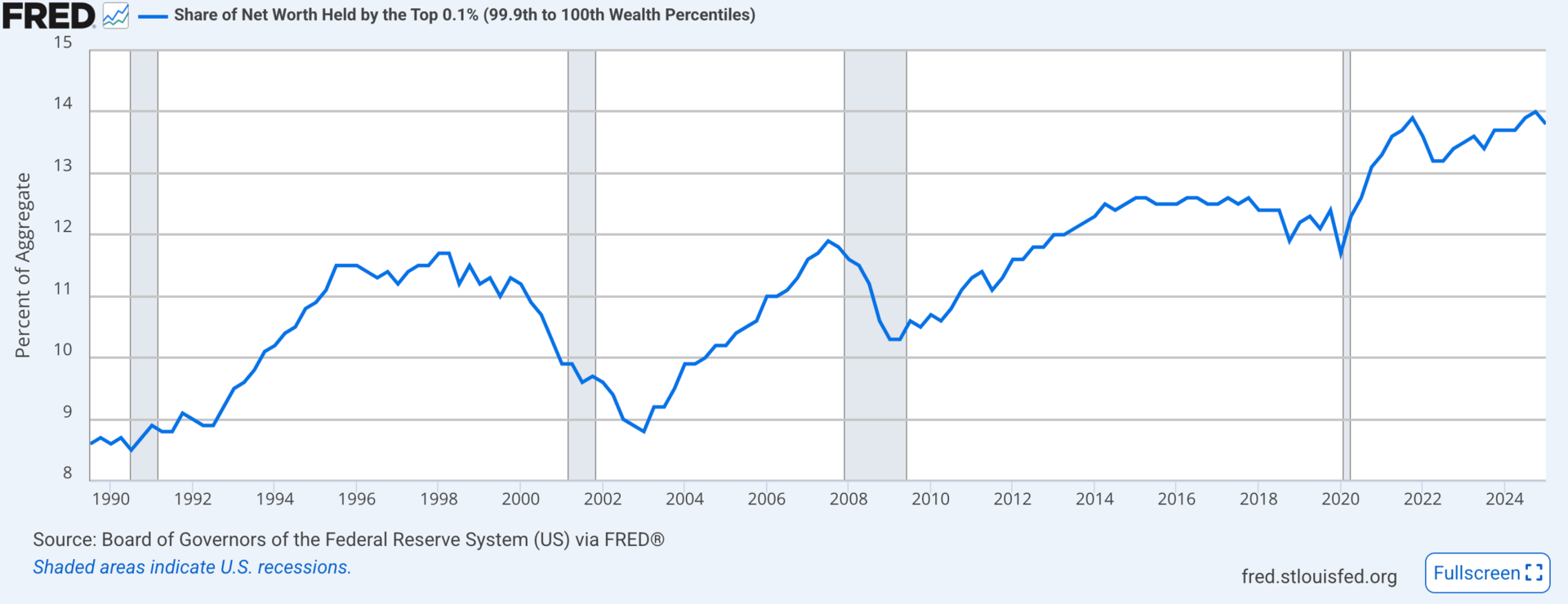

Top 0.1 % Wealth Share: The richest one-thousandth of Americans controlled ≈8% of the nation’s net worth in 1990; today they grip more than 14%; a staircase that spikes every time the Fed turns on the money hose.

PAY ATTENTION: Each crisis shower of freshly printed dollars vaults the ultra-rich up another step, while everyone else fights over the shrinking share below; this chart is the kill-shot proof that bailouts don’t trickle down, but rather pile up at the top.

STRESS FRACTURES SPLITTING THE MIDDLE

Disposable-Income Crunch - Real wages frozen while Consumer Price Index (CPI) rises.

Debt Spiral - Households plug gaps with 20 % plastic.

Crisis Reflex - Every shock bloats the Fed’s sheet, diluting dollars again.

Wealth Concentration - Asset owners compound gains; renters compound costs.

WHAT IS LIKELY TO HAPPEN NEXT: WHY THE MIDDLE CLASS ALWAYS TAKES THE PUNCH

Where We Stand Right Now

Fact | Plain-English Meaning |

|---|---|

Federal IOU pile: ≈ $37 trillion | Uncle Sam’s credit card is maxed out and still swiping. |

Interest bill: ≈ $1 trillion a year | More of your tax money now pays “late fees” than funds the military. |

Refinance treadmill: 40% of that debt rolls over in the next 3 years | If rates jump (currently @ ~5%), Washington’s monthly payment jumps instantly. |

Middle-class squeeze: credit-card balances at record highs; starter homes outrun wages | Families are plugging holes with 22% APR plastic while asset owners cash bigger checks. |

The Fed’s Two Doors, and the One It Always Picks

Door A: Deflation | Door B: Inflation |

|---|---|

Let rates rise, let weak banks fail, let prices fall. | Cap rates by printing dollars and buying bonds. |

Pros: cheaper groceries & houses later. | Pros: prevents market crash & mass layoffs now. |

Cons: 1930s-style unemployment, pension wipeouts, angry voters. | Cons: higher everyday prices, wider wealth gap. |

Why the Fed picks Door B every time:

Politicians prefer angry tweets about milk prices to angry crowds about lost jobs.

Banks, pensions, and the stock market can’t survive sudden deflation—but they profit handsomely in mild inflation.

Once voters, mortgages, and 401(k)s have been wired to cheap money, the “easy” button becomes the only button.

Step by Step: How the Next “Rescue” Unfolds

When | Fed move | What You’ll Notice | Who Wins/Loses |

|---|---|---|---|

Auction scare (Day 0-7) | Panic spreads as buyers demand higher rates for Treasuries. | News flashes: “Bond market turmoil.” | Nobody wins; stocks drop. |

Printer on (Week 2) | Fed announces it will buy “whatever it takes.” | Wall Street rallies; most people shrug. | Asset owners win first. |

Rates capped (Month 1-3) | Fed quietly sets an invisible ceiling under 5%. | Mortgages stop climbing, stocks pop, crypto jumps. | Investors win; renters see rent hike notices. |

Prices chase money (Month 4-18) | Extra dollars slosh into the real economy. | Groceries, rent, childcare +5-8%. Raises lag. | Owners of assets still winning; wage earners falling behind. |

New normal (Year 2-5) | Inflation settles at stubborn 4-6%. | Everything costs “just a bit more” every year. | Middle class thins; barbell society hardens. |

Why That Sequence Shrinks the Middle Class

Early money = cheap money. Banks, hedge funds, and corporations borrow first and buy assets before prices jump.

Late money = expensive life. Paychecks arrive after the price hikes. Raises only partly cover the gap, so families swipe credit cards.

Assets vs. wages. A $400,000 house inflating 8% adds $32,000 to owner wealth. A $70,000 salary rising 3% adds $2,100; wiped out by higher rent and groceries.

Cycle repeats. Each rescue avoids a crash but carves another slice out of the middle, the have-nots stretch thinner, the haves stack higher.

What You Can Do Before the Alarm Goes Off

Plain, doable moves, not hedge-fund tricks.

Own at least one climbing asset: a broad stock index fund, a small rental, or a side business. Even a tiny slice beats zero slice.

Fix every rate you can: kill variable-rate balances, refinance to fixed loans. Inflation helps debtors, only if the rate is locked.

Keep “opportunity cash,” not “stuff-in-a-jar cash”: 3-6 months in a 5% online savings account; invest the extra. Idle cash loses fastest in Door B world.

Train for human-heavy work: sales that require trust, skilled trades, cybersecurity, creative problem-solving. Raises come easier where robots struggle.

Build local cost-sharing circles: food co-ops, tool libraries, babysitting swaps. The less you spend on inflated basics, the more you can channel into assets.

FRAUDFATHER BOTTOM LINE

New money shows up where money already lives. Convert spare dollars into productive assets, crush high-interest debt, and weave local safety nets. When push comes to shove, the Fed will always print to save the system. Printing saves Wall Street first. Make sure you own something, anything, that floats up with that tide, or be ready to watch the velvet rope move one step closer to your front door.

QUICKLINK LIBRARY: BOOKMARK THESE

TERMCBCCALLNS -https://fred.stlouisfed.org/series/TERMCBCCALLNS

WFRBSTP1300 - https://fred.stlouisfed.org/series/WFRBSTP1300

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.

This newsletter is for informational purposes only and promotes ethical and legal practices.