- The Fraudfather's Dead Drop

- Posts

- Fraud, Fear, and the Inflation Game: Outsmarting the Hidden Thieves

Fraud, Fear, and the Inflation Game: Outsmarting the Hidden Thieves

The Hidden Tax: Fighting Back Against Inflation's Silent Theft

Inflation isn’t just a drain on wealth—it’s an insidious tax, levied without consent and paid for in lost purchasing power, eroded savings, and shattered confidence. But it’s more than numbers on a chart or percentages in a headline. Inflation is the thief you can’t see, the one siphoning away the fruits of your labor while you’re left wondering where it all went.

This isn’t a problem for the future—it’s here, it’s now, and it’s personal. My passion lies in exposing and defeating this silent enemy. For too long, people have been left vulnerable, misled into clinging to false solutions or duped into schemes that promise safety but deliver ruin. Fraud doesn’t just exploit inflation—it thrives on it. Understanding this dynamic isn’t just about protecting your wealth; it’s about reclaiming your power.

Every week, The Fraudfather tackles these unseen battles. Whether it’s identifying the tactics scammers use to exploit fear or breaking down the cognitive biases that make us their ideal prey, this newsletter arms you with the tools to fight back. Inflation is the stage, but deception is the script—and together, we can rewrite it.

In This Week’s Issue

The Puppet Masters of Fraud 🎭💸: How pig butchering scams have siphoned over $75 billion globally and what you can do to shield your portfolio.

LLM Phishing Tactics 🔐📧: The rise of AI-powered spear phishing and why your inbox is the new battlefield.

Juvenal’s Wisdom 📜⚖️: What ancient Rome’s biting satirist can teach us about privilege, justice, and crime.

Loss Aversion Exposed 📉🧠: How inflation weaponizes fear, and why scammers love a nervous mark.

Dostoyevsky’s Conscience 🕊️🖋️: Guilt as punishment—what Crime and Punishment teaches us about morality and fraud.

Deception evolves, but so must your defenses. Let’s uncover the hidden truths and take control of the narrative. Stay sharp.

Join The Syndicate: Your Gateway to Fraud Prevention Careers

For those drawn to the fight against deception, The Syndicate is your curated hub for fraud prevention careers. Whether you’re a data sleuth, a cybersecurity expert, or a strategist eager to outwit bad actors, this job board connects you with opportunities to make an impact. Explore roles from top-tier organizations, sharpen your skills, and align your career with your passion for justice.

Check it out now at syndicate.fraudfather.me and take the next step in your mission to combat fraud.

“A criminal is a person with predatory instincts who has not sufficient capital to form a corporation.”

Welcome to The Federal Reserve: The Board Game—where the banker prints money and you just hope to pass Go.

FRAUDSTER(s) OF THE WEEK

The Broken Tooth Racket—A $7.5 Billion Bloodletting

Indictment Spotlight: Broken Tooth and the Pig Butchering Scams

Wan Kuok-koi, better known by his moniker “Broken Tooth,” has long been the embodiment of criminal audacity, his legend forged in the smoke-filled gambling dens and underworld dealings of Macau. A former enforcer of the notorious 14K Triad, Broken Tooth’s name conjures images of bloody turf wars and backroom extortion. Yet, in a sinister twist befitting a Scorsese epic, his ambitions have evolved from street-level thuggery to global financial conquest.

In 2020, the U.S. Department of the Treasury sanctioned Broken Tooth for his role in transnational organized crime, detailing his involvement in everything from illicit gambling to money laundering. At the time, he seemed an artifact of a bygone era—a gangster too entrenched in the shadows of tradition to adapt to modern financial warfare. But Wan proved them wrong. His pivot to the crypto world was not just an adaptation; it was an escalation.

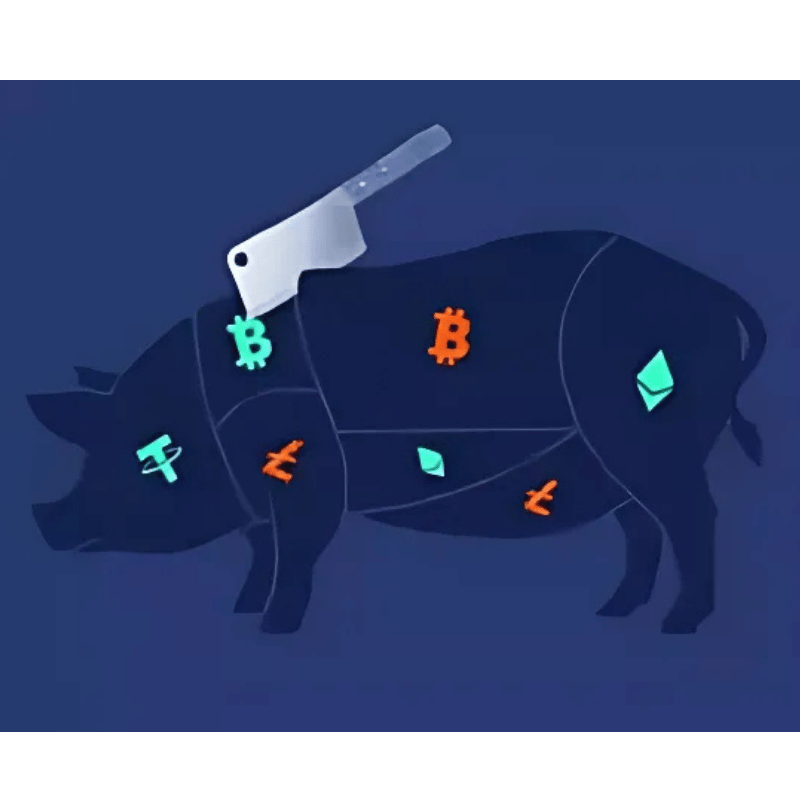

Through a sophisticated network of fraudulent crypto trading platforms and token schemes, Wan masterminded a series of “pig butchering” scams that siphoned over $7.5 billion from global investors. The scheme, named for the methodical fattening of victims before financial slaughter, preyed on the same vulnerabilities he once exploited in the casinos of Macau: greed, trust, and desperation.

But this was no lone wolf operation. Wan reportedly leveraged his Triad connections to create an empire of deceit, coordinating hackers, marketers, and enforcers across borders. His scams didn’t just drain bank accounts; they shattered lives, proving that his exile from Macau’s gambling underworld was merely a chrysalis for a more insidious form of predation.

The Rise of Broken Tooth’s Digital Syndicate

The Treasury Department’s sanctions may have limited Wan’s movement, but they did little to curb his ingenuity. From the ashes of his sanctioned businesses rose a digital empire, sleek and global in its reach. Wan’s transition to crypto was more than a business move; it was a masterclass in the adaptation of old-school criminality to new-age technology.

He capitalized on the burgeoning allure of cryptocurrency, constructing a labyrinth of fraudulent investment platforms marketed as the next big thing. Victims were lured in with promises of high returns and exclusive access, often through social engineering tactics that bordered on psychological warfare. Romance, mentorship, and false camaraderie were the tools of his trade—trust the strings he pulled to orchestrate financial devastation.

Advanced Defense Tactics: Slaughter-Proofing Your Portfolio

For readers of The Fraudfather, defense against this digital abattoir is a matter of intellectual rigor and disciplined skepticism.

Decrypt the Flattery

Be wary of unsolicited investment advice, particularly from strangers cloaked in the pretense of romantic or professional interest. Genuine opportunities rarely slide into your DMs.

Audit the Platforms

Before committing funds, research any platform claiming to be a revolutionary crypto exchange. Verify its licenses, registrations, and history through reputable financial authorities.

Harden Your OSINT Shield

Use open-source intelligence (OSINT) to vet individuals pitching investments. A LinkedIn profile or Instagram account with scant details is often a red flag.

Beware the Herd Mentality

Pig butchering relies on the mirage of social proof. Don’t be swayed by testimonials or group chats teeming with supposed success stories.

Test with Token Amounts

If tempted, start small. Genuine platforms will allow withdrawals, while scammers will press for greater sums with promises of unlocking higher tiers.

Institutionalize Cold Feet

Delay. Any investment that cannot survive a week of scrutiny is not worth pursuing. High-pressure tactics signal desperation—not opportunity.

The Laws of Power, Perverted

Wan Kuok-koi’s orchestration of these scams is a grotesque application of The 48 Laws of Power.

Law 3: Conceal Your Intentions

Victims believed they were engaging with a genuine expert or lover, while the conmen plotted their financial ruin.

Law 27: Play on People’s Need to Believe

The scams preyed on the universal dream of wealth, feeding fantasies of financial freedom.

Law 14: Pose as a Friend, Work as a Spy

Building trust through prolonged emotional manipulation, Wan’s network gathered intimate details to exploit later.

As Cialdini might argue, the syndicate weaponized liking and reciprocity to forge a false bond of trust. But unlike the crude thuggery of traditional gangsters, this psychological warfare underscores a chilling evolution in modern fraud.

The Fraudfather's Take:

The tragedy of pig butchering isn’t just in its scale but in the ease with which it exploits our most human vulnerabilities: trust, hope, and ambition. Wan’s crimes are the techno-dystopian offspring of greed married to innovation. Yet, as with all crimes, the means are irrelevant—it is the method that reveals the pathology.

Cryptocurrency, maligned though it may be, is but the instrument in this symphony of deceit. Scams like these thrive not on blockchain technology but on the blind faith of those dazzled by its promise. Remember: in the world of fraud, the glitter of opportunity often masks the glint of a blade.

Stay vigilant, my friends, for in the age of infinite connections, isolation is no longer your greatest risk. It is the invisible predator lurking behind the guise of a friend.

Book a Call with the Fraudfather! to fortify your defenses today!

PIG BUTCHERING

Tactic 1: The Pig Butchering Playbook: Turning Their Tactics Into Your Shield

The Pig Butchering Playbook: Turning Their Tactics Into Your Shield

The pig butchering scam is a symphony of manipulation, orchestrated with chilling precision. Fraudsters create the illusion of trust, fattening their victims’ confidence before delivering the financial slaughter. But for every scam, there’s a countermeasure. By reverse-engineering their tactics, we can build a fortress around your wealth and livelihood.

Dissecting the Fraud: How Pig Butchering Works

The Lure:

Scammers cast their nets wide, using dating apps, social media, or professional platforms to find vulnerable individuals. They play the long game, building rapport and emotional connections over weeks or months.

The Illusion of Success:

Fraudsters flaunt fake investment successes—screenshots of high returns, fabricated testimonials, and glamorous lifestyles—all designed to bait victims into believing in a golden opportunity.

The Fattening:

Once trust is established, victims are coaxed into small investments, often in seemingly legitimate cryptocurrency platforms. These initial investments yield fake profits, luring victims into doubling down.

The Slaughter:

When the victim has invested heavily, the scammers vanish, taking their funds with them. The sophisticated platforms and glowing promises dissolve into thin air, leaving victims penniless and betrayed.

The Puppet Masters of Fraud: 'Pig Butchering' scams have siphoned over $75 billion globally, preying on trust and ambition. Protect yourself—because in this game, you're the target.

Defense Strategies: Outplaying the Scammers

Cultivate Skepticism of Sudden Friendships

Genuine relationships don’t hinge on financial pitches. Approach unsolicited friendships or romantic connections with caution, especially when they shift toward investment advice.

Verify Investment Platforms

Before committing funds, use tools like Scamwatch or Trustpilot to research the legitimacy of a platform. Check if it’s registered with financial authorities and whether it has undergone audits.

Never Trust “Instant Profits”

High, guaranteed returns are the neon signs of fraud. Real investments fluctuate, and no legitimate opportunity can promise overnight success.

Conduct Reverse Image Searches

Use reverse image search tools to check if the scammer’s profile pictures are stolen. This simple step can reveal if you’re dealing with a fraudster.

Employ Transaction Analysis Tools

Platforms like CipherTrace and Elliptic can analyze cryptocurrency transactions to trace the origins and destinations of funds, exposing suspicious activity.

Test with Token Investments

Start with small amounts if you’re unsure, and attempt to withdraw your earnings before committing larger sums. Fraudulent platforms often block withdrawals under various pretexts.

Fraud Tactics as Power Laws

Pig butchering exemplifies several key strategies from The 48 Laws of Power:

Law 8: Make Others Come to You

By playing the trusted confidant or romantic partner, fraudsters entice their victims to seek their advice and validation.

Law 32: Play to People’s Fantasies

The dream of financial freedom blinds victims to glaring red flags.

Law 33: Discover Each Man’s Thumbscrew

Scammers exploit emotional vulnerabilities—loneliness, ambition, or desperation—to gain control over their targets.

From a Cialdini perspective, these scams exploit the Principles of Liking and Scarcity. Fraudsters forge emotional bonds to build trust while creating a false sense of urgency to spur action.

The Fraudfather’s Take:

The pig butchering scam isn’t just a crime; it’s a psychological war. Fraudsters aren’t just stealing money—they’re weaponizing trust, hope, and human connection. The best defense isn’t paranoia but preparation. Understand their playbook, question every opportunity, and remember: when the stakes are high, skepticism is your strongest ally.

In this arena, the fight is not just for your wealth but for the integrity of your judgment. Stay sharp, stay informed, and most importantly, stay in control. The battle isn’t just against fraud—it’s against complacency.

PHISHING

Tactic #2: LLM Phishing: The New Face of Manipulation

Tactic Spotlight: The Rise of AI-Assisted Spear Phishing

In 2025, phishing attacks will take on a disturbing new form, powered by large language models (LLMs). Criminals no longer need to develop these tools themselves. Instead, they steal credentials to jailbreak existing models like ChatGPT, Claude, or Gemini, enabling them to craft hyper-personalized and convincing phishing campaigns at scale.

Gone are the days of poorly written, easily spotted phishing attempts. With LLMs, attackers can generate emails and messages tailored to their victims’ preferences, habits, and even local surroundings. Imagine receiving an email that mentions your favorite coffee shop or a recent purchase—crafted so precisely that it feels authentic. This is the future we are stepping into, and it’s one where the old adage of “think before you click” has never been more relevant.

The greatest concern isn’t just the scale but the sophistication. Crystal Morin, a former intelligence analyst and cybersecurity strategist, warns: “It’s machine against machine now. We’re in a footrace, and they’re getting better at leveraging this technology faster than we are at defending against it.”

The Playbook: How LLM Phishing Works

Data Harvesting

Attackers collect vast amounts of personal data from social media, breaches, and online activity. This information forms the backbone of their hyper-targeted campaigns.

LLM Crafting

Using stolen credentials, criminals access LLMs to generate flawless emails, texts, and even voice messages tailored to individual victims.

Bait Deployment

Phishing messages reference real-life details—your bank, a local restaurant, or even recent transactions—making them almost indistinguishable from legitimate communications.

Hook and Breach

Victims click on links or provide sensitive information, giving attackers access to accounts or systems. From there, lateral movement and further exploitation occur.

Monetization

Credentials, access, and stolen data are sold on the dark web or used for more extensive attacks, leaving victims footing hefty bills and struggling to recover.

Weaponized LLMs in Action

Reports from 2024 documented attackers using stolen credentials to access AI services like Anthropic’s Claude and OpenAI’s ChatGPT. These criminals didn’t just experiment; they industrialized the process, selling access to others and racking up daily costs of $46,000 for victim organizations. Sysdig’s researchers noted a tenfold increase in LLM requests during July 2024 alone, showcasing the explosive growth of this threat.

Defense Strategies: Fighting Fire with Fire

Multi-Layered Authentication

Implement multi-factor authentication for all accounts, making it harder for attackers to weaponize stolen credentials.

Train Against AI-Enhanced Phishing

Regular training on spotting hyper-realistic phishing attempts is critical. Teach employees to scrutinize sender addresses and contextual details.

Deploy AI for Defense

Use AI tools to detect and flag phishing attempts. Models like Claude and GPT can analyze suspicious messages, providing recommendations for further action.

Minimize Your Digital Footprint

Avoid oversharing personal details online. The less information attackers have, the harder it is for them to craft convincing bait.

Challenge and Verify

Encourage employees to verify unusual requests through trusted channels, especially if they involve financial transactions or sensitive data.

The Laws of Power at Play

LLM phishing is a chilling demonstration of The 48 Laws of Power:

Law 6: Court Attention at All Costs

Hyper-personalized messages capture victims’ attention and make them act impulsively.

Law 32: Play to People’s Fantasies

By referencing local details or exclusive offers, attackers exploit victims’ desires for convenience and opportunity.

Law 21: Play a Sucker to Catch a Sucker

Fraudsters feign authenticity and familiarity, making victims lower their guard.

From a Cialdini perspective, these scams weaponize the Principle of Liking by mimicking trusted entities and Reciprocity through enticing offers.

The Fraudfather’s Take:

LLM phishing represents the terrifying marriage of human psychology and machine intelligence. The line between trust and deception has blurred, and vigilance is now our greatest weapon. Hyper-personalized phishing isn’t just a possibility—it’s an inevitability. Protecting yourself means adopting a zero-trust mindset, questioning every interaction, and leveraging the same technology to fortify defenses.

In this digital battleground, the stakes are high, and the rules are evolving. Remember: the greatest con is the one you never see coming. Stay sharp. Stay skeptical. Stay safe.

Criminal Insights

“Many commit the same crimes with a very different result. One bears a cross for his crime another a crown.”

The Fraudfather's Note: Juvenal, a Roman poet from the 1st and 2nd centuries AD, is renowned for his Satires, a collection of biting commentaries on the moral decay and social hypocrisy of ancient Rome. His quote, “Many commit the same crimes with a very different result. One bears a cross for his crime, another a crown,” underscores the inequities of justice and power. In Juvenal’s time, the elite often escaped the consequences of their actions, while the less fortunate bore the full weight of punishment. This observation resonates through history, highlighting how privilege and societal position can dictate outcomes far more than the nature of the crime itself. Juvenal’s sharp wit and unflinching critique of corruption continue to provoke reflection on the arbitrary nature of justice and the enduring disparities in human societies.

““The man who has a conscience suffers whilst acknowledging his sin. That is his punishment.””

The Fraudfather's Note: Fyodor Dostoyevsky, one of Russia’s most profound literary minds, explores the depths of human morality, guilt, and redemption in his masterpiece Crime and Punishment. Published in 1866, the novel delves into the psychological turmoil of Rodion Raskolnikov, a destitute former student who commits a murder under the delusion that it serves a greater good. Dostoyevsky’s quote, “The man who has a conscience suffers whilst acknowledging his sin. That is his punishment,” reflects the novel’s central theme: the weight of guilt as an inescapable punishment, more profound than any external consequence. Through Raskolnikov’s journey of suffering and eventual redemption, Dostoyevsky challenges readers to confront the complexities of moral transgressions and the human need for atonement. As a writer who endured imprisonment, exile, and financial ruin, Dostoyevsky infuses his work with an unparalleled understanding of the human spirit, making Crime and Punishment a timeless exploration of conscience and the cost of wrongdoing.

Daniel Kahneman: The Architect of Behavioral Insights—captured amidst the abstract representation of cognitive biases that shaped his groundbreaking work in decision-making and human psychology.

Loss Aversion: Inflation as a Thief of Wealth

The Psychology of Loss: Why Fear Outweighs Fortune

Daniel Kahneman, Nobel laureate and clinical dissector of the human psyche, exposed one of our most maddening flaws: we are creatures ruled not by reason but by our aversion to loss. His work in Thinking, Fast and Slow unveils a truth so glaringly obvious it’s unsettling: the pain of losing $50 lingers far longer than the joy of finding $50 ever could. This principle, called loss aversion, doesn’t merely explain a passing disappointment; it defines the irrational architecture of human decision-making.

In normal times, this bias shapes everything from how we haggle over the price of a used car to why we hoard sentimental junk. But in inflationary periods, when each dollar seems to dissolve like sugar in rain, loss aversion mutates into a crippling handicap. It drives people to clutch at what they perceive as safe—even when that "safety" is nothing more than a mirage crafted by fraudsters and opportunists. In these moments, our instinct to avoid pain becomes the very mechanism of our undoing.

Kahneman’s Experiments: The Mug and the Wallet

Kahneman’s genius lies in his ability to turn everyday scenarios into windows into our flawed mental machinery. Consider this: you find $50 on the street. It’s a fleeting high, a dopamine rush that barely lasts the walk home. But lose that same $50 from your wallet, and the emotional sting will stay with you for days, gnawing at the corners of your mind. Why didn’t you double-check your pocket? Could you have dropped it at the gas station? The pain isn’t proportional—it’s punishing.

This isn’t just anecdotal. Kahneman’s research shows that the psychological impact of losses is typically twice as powerful as equivalent gains. It’s why gamblers chase their losses more aggressively than their wins, and why investors hold onto failing stocks long after logic tells them to cut their losses.

One of Kahneman’s most elegant demonstrations of loss aversion involved something as mundane as a coffee mug. He handed participants a mug and asked how much they’d sell it for. He then asked others, who didn’t own the mug, how much they’d pay to buy it. The results were stark: owners valued the mug at nearly twice the price buyers were willing to pay. Ownership, it turns out, transforms even trivial objects into treasured possessions. The mug becomes my mug, and parting with it feels like a loss—even when the buyer sees it as nothing more than ceramic and glaze.

Now extrapolate this to your financial life during inflation. Your retirement savings, your house, your "safe" investments—these aren't just assets. They’re extensions of your identity, fortified by the belief that they represent security. The idea of losing them, even for a better long-term strategy, becomes unbearable. It’s this cognitive quicksand that keeps people clinging to doomed strategies or rushing into scams that promise to "protect" what they already own.

Walking the Crumbling Bridge of Inflation: As fear of loss intensifies, fraudsters wait in the shadows, ready to exploit the vulnerable with promises of false security.

Modern Inflationary Examples of Loss Aversion

Stock Market Hoarding

During inflationary periods, investors often resist selling underperforming stocks, fearing they’ll crystallize their losses. Instead of reallocating to inflation-hedged assets, they hold onto declining equities, compounding their financial woes.

Gold Fever Revisited

As in Kahneman’s examples, people overvalue assets like gold during inflation, clinging to the belief that it is an unassailable safe haven. Scammers exploit this by selling counterfeit bullion or dubious gold-backed securities, leveraging the emotional need to avoid perceived losses.

The Coupon Paradox

In times of rising prices, consumers flock to couponing and discount schemes, driven by the fear of losing money on full-price items. Scammers lure them with fake “exclusive deals” or rebate programs, knowing they’ll act impulsively to avoid perceived overspending.

Retirement Panic

Inflation erodes purchasing power, prompting retirees to panic and shift investments into low-yield bonds or annuities. Scammers prey on this fear, offering fake “inflation-protected” retirement plans that vanish once the money is transferred.

Defusing Loss Aversion: Practical Strategies

Reframe the Narrative

Kahneman teaches us to shift perspective. Instead of focusing on potential losses, consider the opportunity costs of inaction. For instance, selling a poor-performing asset isn’t a loss—it’s freeing up capital for better investments.

Use Probabilistic Thinking

When faced with inflation, don’t let fear dominate. Evaluate options rationally, weighing the likelihood of outcomes rather than reacting to immediate discomfort.

Set Rules and Automate Decisions

Automate savings and investment decisions to avoid emotional interference. Pre-determined allocations can protect against impulsive, loss-averse behaviors.

Diversify Your Defenses

Inflation magnifies risk. Spread investments across asset classes like commodities, inflation-linked bonds, and equities rather than anchoring to familiar but unsafe options.

Pause and Reflect

Before making financial moves, ask yourself: “Am I acting out of fear of loss or pursuit of growth?” This question can help redirect loss-averse decisions into productive strategies.

The Fraudfather’s Take: Thieves Love a Nervous Mark

Loss aversion doesn’t just make us irrational—it makes us predictable. And predictability is a con artist’s best friend. During periods of economic uncertainty, fraudsters sharpen their tools, crafting schemes that prey on our deepest fears.

Inflationary periods, like the one we’re navigating now, amplify loss aversion to a fever pitch. Every grocery bill and energy payment feels like a direct attack on your financial stability. The fear of losing more tomorrow drives people to act impulsively today. It’s why dubious “inflation-proof” investments flourish, why gold scams reemerge from their gilded tombs, and why counterfeiters sell you the illusion of security in exchange for your dwindling savings.

The lesson from Kahneman’s experiments isn’t just that humans fear loss—it’s that this fear blinds us to better options. And when inflation erodes your wealth, that blindness becomes the lever fraudsters use to pry open your defenses.

Remember: Fear sharpens the conman’s blade. In a world where every dollar feels like it’s slipping away, Kahneman’s insights aren’t just academic—they’re survival skills.

About The Fraudfather

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.

This newsletter is for informational purposes only and promotes ethical and legal practices.