- The Fraudfather's Dead Drop

- Posts

- Fed Decision Wednesday: The Wealth Transfer Activates

Fed Decision Wednesday: The Wealth Transfer Activates

How the $9.2 trillion debt crisis activates systematic wealth transfer, while scam data reveals that younger Americans are becoming prime targets; complete positioning protocols for both financial and security threats.

The Great American Heist: How Wednesday's Fed Meeting Continues the Perfect Crime

GM, Welcome Back to the Dead Drop.

Last week I warned you about the $9.2 trillion debt refinancing crisis that may lead to traditional money printing or an asset revaluation strategy targeting gold and Bitcoin. That mathematical death spiral I outlined? It's about to go operational.

This Wednesday's Fed meeting isn't just monetary policy, it's the activation phase of the wealth transfer mechanism I detailed in our previous intelligence briefing. The refinancing crisis that demanded resolution is now forcing the Fed's hand, and the positioning advantages I identified are about to become critical.

I've investigated elaborate schemes that would make Hollywood scriptwriters weep with envy. But I've never encountered a fraud operation more sophisticated, more devastating, or more perfectly legal than what's happening this Wednesday when the Federal Reserve cuts interest rates while stocks sit at record highs.

This isn't just monetary policy, operatives. This is the systematic execution of the largest wealth transfer in American history, and the middle class is the mark. The debt refinancing crisis I analyzed last week demanded resolution through either traditional money printing or asset revaluation. Wednesday's Fed decision activates that wealth transfer mechanism.

This isn't just monetary policy, operatives. This is the systematic execution of the largest wealth transfer in American history, and the middle class is the mark. The debt refinancing crisis I analyzed last week demanded resolution through either traditional money printing or asset revaluation. Wednesday's Fed decision activates that wealth transfer mechanism.

The Setup: A Crime in Plain Sight

On September 17-18, markets are pricing in a 91% probability that the Fed cuts the federal funds rate for the first time since December 2024, potentially marking the most audacious heist in financial history. Here's what makes this unprecedented: there have been only 2 years since 1996 where the Fed cut rates while stocks were at record highs, 2019 and now 2025.

While Polymarket traders give 91% odds for a 25 basis point cut, Morgan Stanley analysts put the actual probability closer to 50-50, asking a devastating question: "What problems would the Fed be trying to solve by easing?"

Here's what makes this unprecedented: there have been only 2 years since 1996 where the Fed cut rates while stocks were at record highs, 2019 and now 2025.

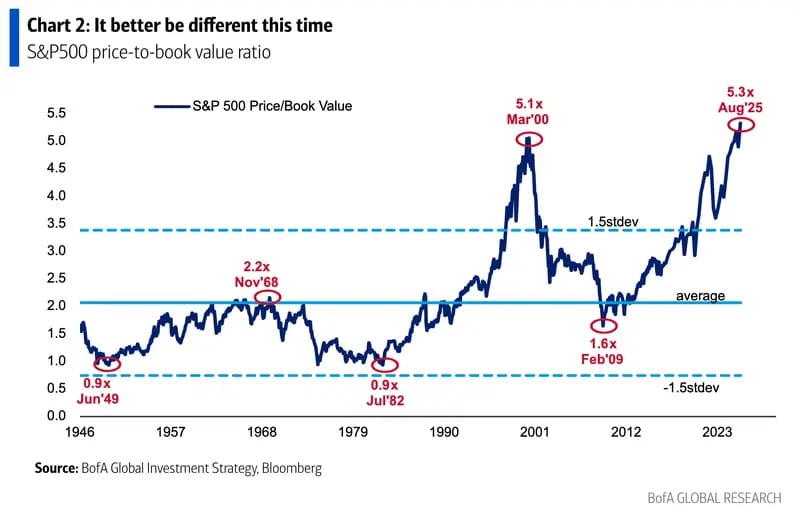

Their analysis is damning: equity valuations are in the 95th percentile going back 80 years, financial conditions are the most con

structive since May 2022, and corporate bond issuance is near record highs. Translation: there's no financial crisis requiring emergency monetary stimulus. Interestingly, Polymarket's top trader just placed a $15,000 bet on a 50 basis point cut, a position that could pay $226,000 if correct.

The con? Core inflation is running at 3.1%, well above the Fed's 2% target, while nominal GDP growth remains robust above 5%. Translation: The economy is hot, asset prices are already inflated to dangerous levels, and inflation is stealing purchasing power from working Americans. Yet betting markets give 91% odds the Fed pours gasoline on this fire.

Core inflation is running at 3.1%, well above the Fed's 2% target

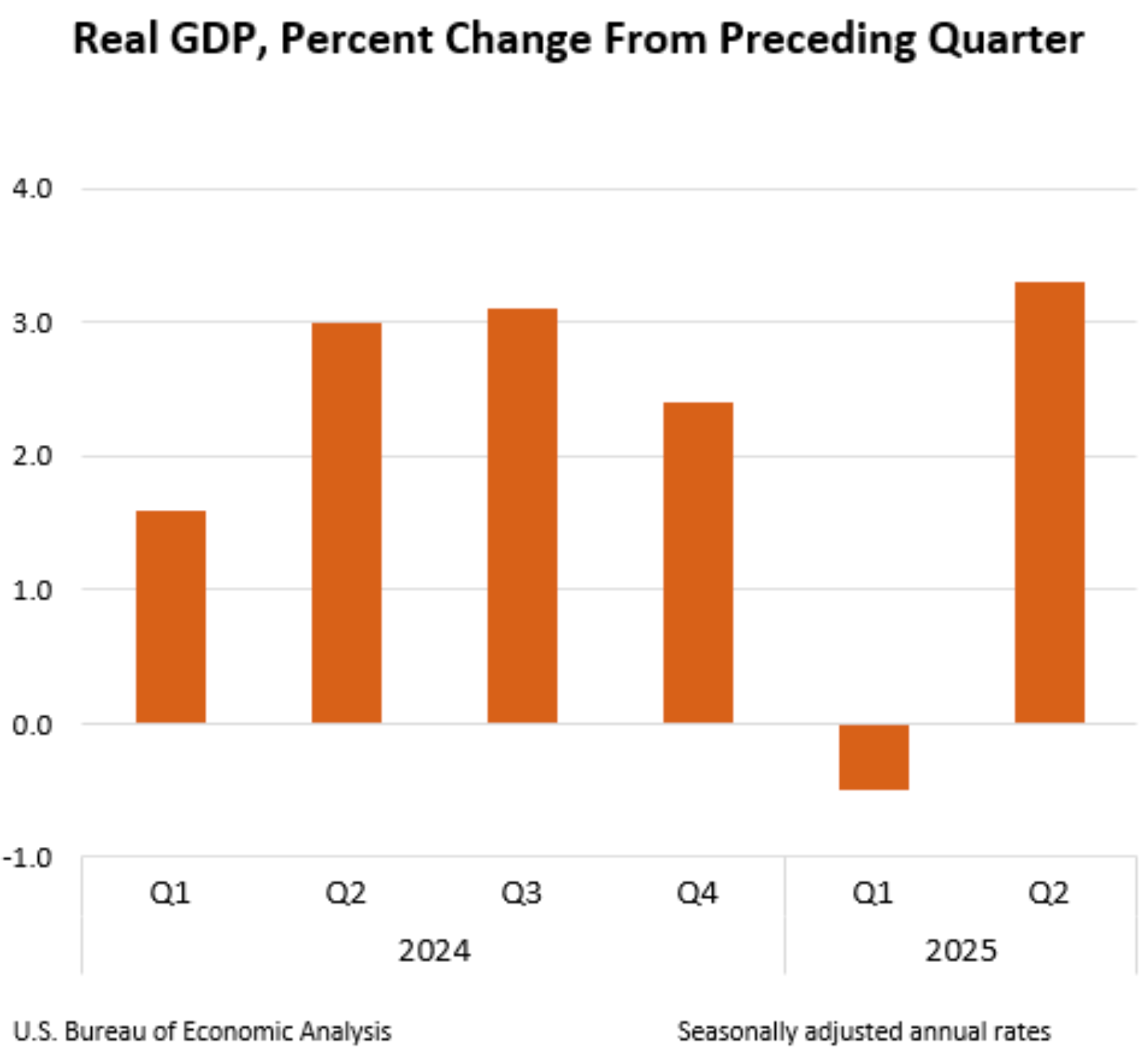

GDP growth remains robust above 5%. Translation: The economy is hot, asset prices are already inflated to dangerous levels, and inflation is stealing purchasing power from working Americans.

The mathematics of currency debasement reveal the systematic theft in plain sight: $100 today possesses the same purchasing power as just $12.05 in 1970, an 88% destruction of value over five decades of monetary expansion.

The 1970s inflation acceleration that destroyed savings accounts is already repeating, with inflation spiking from near-zero to over 9% between 2020-2022, the fastest acceleration in fifty years. This forces a brutal strategic reality: in a system where central banks solve fiscal crises through money creation, holding dollars or dollar-denominated instruments becomes guaranteed impoverishment, while those positioned in finite assets, e.g. real estate, commodities, equities with pricing power, precious metals, capture the newly created money through asset price appreciation.

Wednesday's Fed rate cut, despite core inflation at 3.1% and stocks at record highs, accelerates this wealth transfer mechanism by pushing the $7.6 trillion in cash holdings toward risk assets, systematically redistributing purchasing power from wage earners and savers to asset holders who understand that in a debt-based monetary system, you either own real assets or watch your wealth evaporate through legalized currency debasement.

But here's the criminal genius of it all… it's completely legal.

The Criminal Playbook: How the Wealth Transfer Machine Works

Successful fraud schemes understand one fundamental truth: the best heists don't look like crimes. They look like policy.

Phase 1: Create the Conditions When the Fed cuts rates, it primarily works by raising asset prices, e.g. stocks, bonds, real estate. The wealthy, who own 93% of financial assets, see their portfolios surge. Meanwhile, middle-income households experience inflation rates of 19% at peak periods while their wages stagnate.

Phase 2: Execute the Transfer Here's where the fraud becomes crystal clear: from 1983 to 2016, the share of aggregate wealth held by upper-income families increased from 60% to 79%, while the middle class saw their share cut nearly in half, falling from 32% to 17%. This isn't economic evolution, it's systematic theft through monetary policy (Pew Research.)

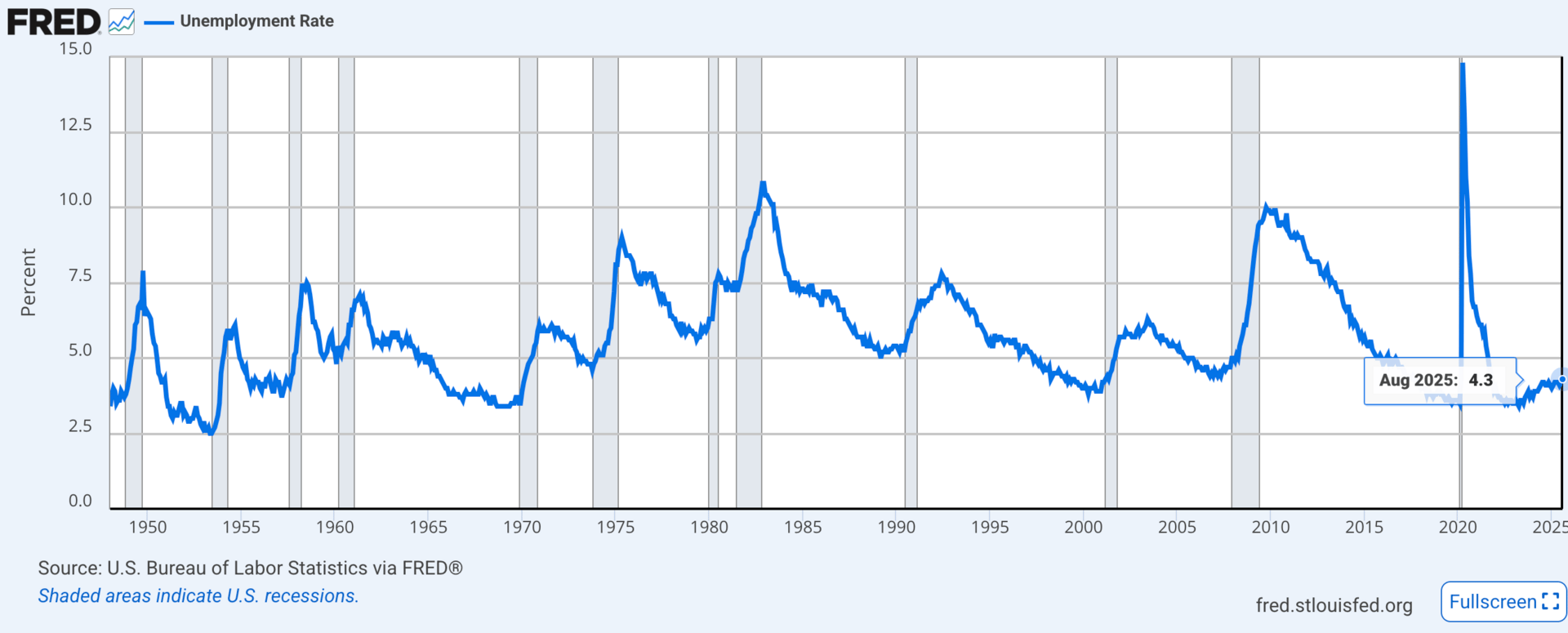

Phase 3: Cover the Tracks The beautiful criminality of this scheme is that it masquerades as helping employment. Despite GDP growing at 3%+ annually and unemployment at just 4.3%, the Fed claims it must cut rates due to "labor market weakness." But the data tells a different story: this is about protecting asset prices, not jobs.

Despite GDP growing at 3%+ annually and unemployment at just 4.3%, the Fed claims it must cut rates due to "labor market weakness." But the data tells a different story: this is about protecting asset prices, not jobs.

The Operational Reality: Who Wins, Who Loses

In financial crime, you follow the assets to find the theft. And the assets tell a clear story:

The Winners:

$7.6 trillion sits in money market funds, ready to flow into risk assets when rates drop

Asset holders who benefit from the "wealth effect" of inflated stock and real estate prices

The top 10% who own 93% of wealth and will see their portfolios surge

The Marks:

Nearly 60% of Americans who don't have enough savings to handle common financial emergencies

Middle-class families whose wages can't keep pace with asset price inflation

Lower-income households who have seen their spending growth fall to just 0.6% while higher-income households posted 1.8% growth

The most insidious part? Research shows that while inflation acts as a tax on incomes, it actually benefits middle-class homeowners through asset appreciation. But here's the criminal twist: the same system that gives them a small asset boost simultaneously destroys their purchasing power through wages that can't keep pace.

The Psychological Manipulation

Every successful fraud relies on the mark not understanding they're being victimized. The technique is called "complexity obscuration," make the scheme so complex that victims can't see the theft.

The Fed's dual mandate, employment and price stability, is the perfect cover story. They claim to fight unemployment while systematically transferring wealth from wage earners to asset holders. The employment effects dominate public perception, but the wealth transfer effects are what really matter for long-term inequality.

Meanwhile, at peak inflation periods, 64% of low-income Americans report high stress from price increases, compared to just 17% of wealthy Americans. The criminal understands exactly who bears the cost.

Field Manual: Defensive Protocols

Here's how you protect yourself from this systematic wealth transfer:

Early Warning Systems:

Monitor the velocity of money, e.g. when $7.6 trillion in cash starts moving into risk assets, inflation follows

Track commodity prices as leading indicators of inflation that will hit your wallet first

Watch for divergence between asset prices and economic fundamentals

Verification Procedures:

Understand that your wages are being systematically devalued by design

Recognize that cash savings are being intentionally eroded through negative real interest rates

Accept that traditional "safe" investments are actually wealth destruction vehicles

Response Protocols:

Own Assets, Not Currency: Gold and Bitcoin have been pricing in this wealth transfer, with straight-line higher price action

Leverage Real Estate: If you're going to be forced into this system, use fixed-rate debt to your advantage

Protect Purchasing Power: Invest in assets that maintain value during inflationary periods

Critical Action Items:

Hard Asset Foundation: Physical gold and Bitcoin provide the base layer of inflation protection, i.e. assets with finite supply that can't be printed or debased

Productive Asset Ownership: Equities in companies with pricing power, essential services, or hard asset ownership, i.e. businesses that adjust revenue with inflation rather than getting crushed by it

Real Estate with Leverage: Fixed-rate debt on appreciating assets means you repay loans with devalued currency while the underlying asset maintains real value

Avoid Currency Instruments: Bonds, savings accounts, and cash-equivalent instruments become systematic wealth destruction vehicles when central banks solve fiscal problems through money creation

The Fraudfather Bottom Line

Wednesday's Fed meeting represents the continuation of a decades-long con game. Historical data shows that when the Fed cuts rates within 2% of all-time highs, the S&P 500 has risen an average of 13.9% over the following 12 months. Meanwhile, middle-class purchasing power continues its systematic destruction.

This isn't conspiracy theory; it's conspiracy fact. The evidence is overwhelming:

Asset valuations have reached their highest level on record, surpassing both the Dot-Com bubble and 1929

The top 10% of Americans now own 93% of wealth while the middle class shrinks

Inflation consistently outpaces wage growth, creating a systematic transfer mechanism

The Fed cuts rates into this environment, accelerating the wealth transfer

The most dangerous criminals aren't the ones who threaten you with violence. They're the ones who understand exactly what you need to hear while they systematically rob you blind. The Fed's "dual mandate" is the perfect cover story for the greatest heist in American history.

Here's the hard truth: You can't stop this machine. But you can stop being its victim.

The choice is simple: understand the game and position yourself accordingly, or continue funding the wealth of others with your diminished purchasing power. The Fed has made their move. Now it's time to make yours.

Remember the positioning protocols from our debt crisis analysis: Assets that maintain purchasing power during currency debasement fall into clear categories. Hard assets with finite supply characteristics, e.g. precious metals, real estate with fixed-rate debt, productive businesses with pricing power, historically preserve wealth when governments resort to monetary expansion.

The key insight: when central banks create money to solve fiscal problems, that new money competes for the same finite assets. Understanding which assets benefit from monetary expansion versus those that get destroyed by it becomes the difference between wealth preservation and systematic impoverishment.

Whether through traditional money printing or the asset revaluation strategy, wealth transfers from dollar-denominated instruments to officially backed assets. But you need to be positioned before the broader market recognizes what's happening.

Got a Second? The Dead Drop reaches 4,000+ readers every week including security professionals, executives, and anyone serious about understanding systemic wealth transfers. Know someone who needs this intelligence? Forward this newsletter.

How to Choose the Right Voice AI for Regulated Industries

Explore how enterprise teams are scaling Voice AI across 100+ locations—without compromising on compliance.

This guide breaks down what secure deployment really takes, from HIPAA and GDPR alignment to audit logs and real-time encryption.

See how IT, ops, and CX leaders are launching secure AI agents in weeks, not months, and reducing procurement friction with SOC 2–ready platforms.

The Fraudfather's take on the week's biggest scams, schemes, and financial felonies, with the insider perspective that cuts through the noise.

The Age Shift: Why Younger Americans Are Now Prime Targets for Government Imposter Scams

The latest Social Security Administration Office of Inspector General quarterly report reveals a fundamental shift in criminal targeting that every American needs to understand. The data shows something unprecedented: for the first time, more victims under 50 are falling for government imposter scams than those over 50.

In Q3 2025, 329 individuals under 50 reported financial losses to Social Security-related scams, compared to just 184 individuals aged 50 and older. This represents a complete reversal from previous patterns and signals a sophisticated evolution in criminal methodology.

The Criminal Adaptation Strategy

Fraudsters have recognized what law enforcement has been slow to acknowledge: younger Americans represent a more profitable target demographic for specific types of government imposter schemes. The criminals have adapted their approach based on three key insights about millennial and Gen Z psychology.

Digital Native Vulnerability: Younger victims grew up expecting government interaction through digital channels. When scammers send professional-looking emails or text messages claiming to be from Social Security, these victims don't immediately recognize the communication as suspicious. The report shows that 29.2% of scams now involve fraudulent documents or official logos, a 6-point increase from the previous quarter.

Economic Anxiety Exploitation: Younger Americans face unprecedented financial pressures, e.g. student loans, housing costs, and uncertain employment prospects. When criminals offer remote work opportunities or claim there are problems with Social Security accounts that could affect future benefits, these victims respond more readily than older Americans who may be more skeptical of unsolicited contact.

Government Dependency Assumption: Unlike older generations who may distrust government contact, younger Americans often expect government agencies to reach out proactively about benefits, tax issues, or employment opportunities. This makes them more susceptible to initial contact from imposters.

The Financial Impact Paradox

While younger victims are being targeted more frequently, the financial data reveals a crucial pattern that explains the criminal calculus. Although older victims (85+) still lose significantly more money per incident, averaging $33,081 compared to $2,769 for victims under 30, the volume-based approach targeting younger victims appears more sustainable for criminal operations.

This represents a shift from traditional "big score" elder fraud to what we might call "high-volume, moderate-loss" schemes. Criminals have discovered they can generate consistent revenue by targeting more younger victims for smaller amounts rather than focusing exclusively on elderly victims for larger sums.

The mathematics favor this approach: 329 younger victims losing an average of approximately $3,000 each generates nearly $1 million in criminal proceeds, while requiring less sophisticated social engineering than the complex schemes typically used against elderly victims.

The Remote Work Deception

The report highlights a particularly insidious new fraud variant: fake remote job offers claiming to be from Social Security or other government agencies. This scheme perfectly exploits current economic conditions and work preferences.

Criminals pose as hiring personnel offering positions like "administrative assistant," "claims processor," or "virtual benefits coordinator." They use fake SSA email addresses, official-looking documents, and spoofed phone numbers to establish credibility. Victims are then asked for personal information and may be required to pay for training materials or equipment.

This fraud type succeeds because it combines legitimate desires (remote work opportunities) with authoritative impersonation (government employment) while exploiting information gaps (many people don't understand government hiring processes).

The Multi-Agency Impersonation Trend

Perhaps the most sophisticated evolution revealed in the data is criminals' expansion beyond Social Security impersonation. The report shows that 30.9% of scams now involve impersonation of federal, state, or local government agencies other than SSA.

This represents advanced criminal methodology. Instead of limiting themselves to Social Security scenarios, fraudsters now create complex narratives involving multiple agencies. They might claim the victim's Social Security number is involved in a federal investigation requiring contact with the FBI, or that there are tax issues requiring IRS coordination.

This multi-agency approach serves two criminal purposes: it increases the perceived urgency and legitimacy of the contact, and it allows criminals to extend the fraud over multiple interactions, building trust and extracting more information or money over time.

The Document Sophistication Arms Race

The increase in fraudulent document usage, from 23.3% to 29.2% in just one quarter, signals that criminals are investing heavily in creating convincing official materials. Modern technology allows fraudsters to produce documents that can fool casual inspection, complete with official logos, formatting, and even security features.

This technological escalation creates a significant challenge for potential victims. Where previous generations might have been able to spot obvious fakes, today's fraudulent documents can appear completely legitimate to untrained eyes.

Defensive Intelligence

The data reveals several critical warning signs that potential victims must recognize:

Communication Channel Red Flags: Government agencies rarely initiate contact through unsolicited emails, texts, or calls requesting immediate action or personal information. The report specifically warns about emails claiming Social Security statements are available for download.

Employment Offer Skepticism: Any remote job offer claiming government employment that requests personal information or payment for training materials should be immediately suspect. Legitimate government employment follows strict protocols that never involve upfront payments.

Multi-Agency Pressure Tactics: Be particularly wary of any scenario involving claimed coordination between multiple government agencies, especially when urgency is emphasized.

Verification Protocols: Always independently verify any government contact using official phone numbers found on agency websites, never numbers provided by the contact themselves.

The Broader Implications

This demographic shift in victimization represents more than just criminal adaptation, it reveals fundamental vulnerabilities in how younger Americans understand government operations and recognize official communications.

The criminals have identified that digital natives, despite their technological sophistication, often lack the institutional skepticism that protects older Americans from government imposter scams. This knowledge gap creates opportunities for fraud that didn't exist when government interaction was primarily conducted through traditional channels.

As remote work becomes more prevalent and government services increasingly move online, these vulnerabilities will likely expand. The criminal success against younger demographics suggests we're seeing the early stages of a longer-term shift in fraud targeting that will require new educational approaches and defensive strategies.

The SSA OIG data provides clear evidence that the fraud landscape is evolving rapidly, and the assumptions we've held about victim demographics and criminal targeting are no longer reliable predictors of who faces the greatest risk.

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

This newsletter is for informational purposes only and promotes ethical and legal practices.