- The Fraudfather's Dead Drop

- Posts

- Shadows, Schemes, and Smartphones: Dexter's Luck, Your Risks, and the Art of Staying Ahead

Shadows, Schemes, and Smartphones: Dexter's Luck, Your Risks, and the Art of Staying Ahead

Shadows, Schemes, and Smartphones: Dexter's Luck, Your Risks, and the Art of Staying Ahead

The Fraudfather’s Dead Drop: Welcome to the Nexus

They say power reveals the truth of a person’s character. Yet, in this age of digital interconnection, power is no longer the exclusive realm of kings and titans—it resides in the hands of fraudsters, AI-driven schemes, and the faceless forces siphoning away your security, wealth, and peace of mind. I’m JT, “The Fraudfather,” and each week, I dissect the strategies of history’s boldest criminals and the latest cyber conmen to arm you with the knowledge to navigate—and dominate—this shadowy terrain.

In this week's issue:

The Digital Don 🌹: Inside the $6M romance scam syndicate preying on trust and identity.

The Phantom Call Protocol 📱 How your smartphone becomes a threat actor’s weapon of choice.

Love, Lies, and Life Savings 💰 The sinister evolution of romance scams targeting the elderly and turning victims into unwilling accomplices.

Criminal Wisdom💡: Insights from Al Capone and Frank Costello, timeless lessons on manipulation and power.

The Luckiest Fraudster Alive 🤡: Timothy Dexter, the accidental king of chaos who turned idiocy into an art form.

Stay sharp, stay vigilant, and never underestimate the power of understanding your adversary.

Let’s uncover the game—and win it.

Power dynamics have always been my obsession—how we wield it, how we lose it, and how it reveals the best and worst in us. Carl Jung spoke of the shadow, the darker impulses we repress but never escape. I’ve come to believe that each of us carries both predator and prey within. The fraudsters I hunt aren’t just ‘out there’; they’re echoes of what we all might become under different circumstances. To understand this is to gain clarity. To ignore it is to remain a victim. The only question is which side of the line you choose to stand on.

The Fraudfather’s Dead Drop: Transforming Lives, One Subscriber at a Time!

FRAUDSTER OF THE WEEK

The Digital Don: How a Romance Scam Ring Built a $6M Empire of Deception

Okechukwu Valentine Osuji’s audacity would make any con artist blush. From behind the glow of a computer screen, Osuji orchestrated a multi-million-dollar fraud scheme spanning continents. The plot? A mix of business email compromise (BEC) schemes and heartbreaking romance scams designed to exploit the most vulnerable among us.

A US Court has sentenced a 39-year-old Nigerian, Okechukwu Valentine Osuji, to eight years in prison after he was found guilty of involvement in a large-scale business email compromise (BEC) scheme.

Osuji’s tactics went beyond simple deception. Posing as trusted business contacts, his syndicate targeted organizations across finance, non-profits, and even food services, tricking them into funneling millions into fraudulent accounts. The losses were staggering, but the human cost was even higher.

Osuji and his co-conspirators preyed on elderly individuals through romance scams, turning unwitting victims into accomplices. One woman, duped by the promise of love, drained her life savings, declared bankruptcy, and lost her home—all while her personal account became a tool for defrauding others. In a horrifying twist, some victims were coerced into compromising situations, recorded without their consent, and subsequently extorted—a chilling escalation of manipulation.

After a dramatic arrest in Malaysia and extradition to the U.S., Osuji was sentenced to eight years in prison and ordered to pay restitution. His co-conspirators are still being pursued, but the damage is done: $6 million in losses, lives shattered, and trust broken.

Key Takeaways:

Hybrid Schemes Are Rising: Osuji’s operation combined business email compromise with romance scams, highlighting how fraudsters merge tactics for greater impact.

Victim-Turned-Accomplice: Fraudsters exploit victims’ emotional and financial vulnerabilities to unwittingly involve them in the crime, further complicating enforcement efforts.

From Fraud to Extortion: Sextortion tactics, such as recording victims in compromising positions, mark a disturbing evolution in romance scams, deepening psychological and financial damage.

Scam Sophistication: The use of AI tools, spoofed caller IDs, and elaborate social engineering continues to make scams alarmingly believable.

The Fraudfather’s Take:

Osuji’s empire of deceit echoes the 48 Laws of Power, particularly “Play on People’s Need to Believe” and “Exploit the Desire for Connection.” His story is a stark reminder that scams thrive on emotional manipulation and fractured trust. To outwit predators, one must question urgency, verify independently, and never underestimate the ruthless ingenuity of fraudsters.

Protect Yourself:

Establish verification protocols for any unexpected financial requests. Be skeptical of online relationships that escalate quickly into financial demands. If in doubt, consult trusted professionals or law enforcement. Trust, once shattered, is hard to rebuild. Stay vigilant, stay informed, and, as always, stay one step ahead.

VISHING

Tactic 1: The Phantom Call Protocol: When Your Smartphone Becomes the Threat Actor’s Weapon.

How It Works:

Spoofed Caller ID: Fraudsters use sophisticated tools to mimic the phone numbers of trusted entities like your bank, utility provider, or even law enforcement agencies.

Scripted Urgency: A caller claims to be from a legitimate organization and fabricates a high-pressure situation—examples include fraudulent transactions on your account, unpaid taxes, or a family member in distress.

Dual-Channel Exploitation: The scammer directs victims to verify the situation through a text message or email sent “by the organization.” This message often contains malicious links or confirmation codes to make the scenario appear authentic.

Social Engineering Mastery: The scammer leverages advanced psychological tactics, like invoking fear of financial loss or social shame, to compel victims to act without verification.

Remote Device Control: Victims are often instructed to download a “security app” or provide access to their phone remotely, giving the scammer control to siphon sensitive data, access bank accounts, or implant spyware.

Real-World Evolution:

Scammers are increasingly integrating voice phishing (vishing) and text phishing (smishing) into seamless, hybrid attacks. The FBI recently warned that attackers are targeting both Android and iPhone users, utilizing their dominance over personal communication channels to exploit trust and familiarity.

Defense Strategies:

Preemptive Measures:

Establish Secret Phrases:

Create a unique "safe word" with family members and trusted contacts to authenticate any urgent calls or messages.

Organizations won’t offer a "safe word" feature yet, so treat callers lacking specific verification with skepticism.

Lock Down Sensitive Features:

Disable call-forwarding features and SIM swapping via your carrier’s support settings.

Regularly update your phone’s firmware to patch vulnerabilities.

Identify Red Flags:

Unsolicited Calls or Texts:

Be cautious of unexpected communication, especially if it involves sensitive topics like finances, taxes, or emergency situations.

Time Pressure:

Legitimate organizations will not demand immediate action or penalties without prior written notice.

Requests for Access:

Never grant remote control of your phone or install apps at a caller's request.

Real-Time Response:

Hang Up Immediately:

End the call if any details seem suspicious and use a verified number from the organization’s website to independently confirm the situation.

Do Not Click Links:

Avoid clicking links in unsolicited messages. Instead, navigate directly to the organization’s website or app.

Leverage Advanced Security:

Enhanced Call Verification:

Use carrier-provided caller ID verification services to detect spoofed numbers.

Encourage organizations you work with to implement voice biometrics for enhanced security.

Spam Filtering Apps:

Install robust spam blockers for calls and texts. These tools can often identify and warn against known phishing campaigns.

Report and Educate:

Notify Authorities:

Report suspicious calls or messages to the FTC, FCC, or the FBI’s Internet Crime Complaint Center (IC3).

Spread Awareness:

Share experiences of phantom calls within your community to ensure others recognize and avoid the threat.

The Fraudfather's Take:

The Phantom Call Protocol is a chilling reminder that your smartphone is not just a tool—it’s a target. Scammers exploit its indispensable role in your life to manipulate trust and fear. By cultivating vigilance, establishing verification protocols, and leveraging advanced security features, you can turn your phone from a vulnerability into a bastion of defense.

Remember: Question urgency, authenticate independently, and never hand over control of your device to an unsolicited caller. Protecting your digital life starts with skepticism and proactive planning.

Book a Call with the Fraudfather! to fortify your defenses today!

ROMANCE SCAMS

Tactic #2: Love, Lies, and Life Savings: How Romance Scams Prey on the Elderly and Turn Victims into Accomplices

Imagine your golden years tarnished not by age, but by betrayal. Romance scams, particularly those targeting elderly individuals, are a masterclass in emotional exploitation. These scams begin innocuously enough—a kind word, a friendly message, a photo of a seemingly genuine suitor. But beneath the charm lies a calculated predator who knows how to weaponize trust and loneliness.

Take the story of Eleanor, a widow in her late 70s, who met “George” online. He was attentive, kind, and shared her love for gardening. George claimed to be an engineer working on a lucrative overseas contract. When a supposed financial snag delayed his return home, Eleanor, eager to help her new love, sent him $25,000. But George wasn’t real, and the money was gone.

The scam didn’t stop there. Eleanor’s financial assistance quickly turned into complicity. George, or rather the fraudster behind him, used her bank account to launder funds stolen from other victims. When Eleanor began questioning his motives, the scam escalated into extortion. Using compromising photos Eleanor had shared, the fraudster threatened to ruin her reputation unless she continued to comply.

Romance scams are particularly devastating because they target the heart, stripping victims of both their finances and dignity. In 2023 alone, victims reported losses of $1.14 billion to romance scams, with median individual losses of $2,000. These criminals often use photos stolen from social media to create convincing personas, isolating victims from their support networks while manipulating them into financial or criminal involvement.

A chilling glimpse into modern manipulation: In a one-minute video posted by a romance scammer on Telegram, a victim is coerced into removing her red blouse as a gesture of ‘apology’ for doubting her supposed lover. This appalling tactic showcases how fraudsters weaponize trust and shame to exploit their victims further.

How the Fraud Works:

Emotional Manipulation: Fraudsters establish quick rapport, showering victims with affection and fabricated stories to build trust.

Isolation: They discourage victims from sharing details of the relationship with family or friends, ensuring their control remains unchallenged.

Financial Exploitation: Requests for money are framed as emergencies—medical bills, travel expenses, or legal fees.

Secondary Victimization: When trust falters, scammers pivot to extortion, using shared photos or personal information as leverage.

Mule Recruitment: Victims’ bank accounts are used to transfer illicit funds, unwittingly implicating them in criminal activity.

Defense Strategies:

Pause and Vet: Use reverse image searches and verify details shared by the person. Discrepancies often reveal the truth.

Guard Your Privacy: Limit personal information shared on social media to reduce susceptibility to targeting.

Engage Trusted Advisors: Discuss any new relationships with family, friends, or financial advisors. An outside perspective can spot red flags.

Report Suspicious Activity: Alert platforms like IC3.gov and the FTC to suspected scams. Reporting prevents further victimization.

Know the Signs: Avoid financial transactions, resist isolation attempts, and remain wary of urgent or high-pressure requests.

The Fraudfather’s Take:

Romance scams are a chilling reminder that love and deception are not mutually exclusive. As the 48 Laws of Power teach us, “Make your victims feel smarter than they are” is a con artist’s gospel. Fraudsters appeal to emotions, creating a false sense of security and connection. Yet, their mastery of manipulation is a testament to the vulnerabilities we often ignore in ourselves.

We are creatures of hope and trust—qualities that make us human but also make us prey. The elderly, often isolated and longing for connection, are especially at risk. The antidote lies in skepticism, vigilance, and empowering loved ones with knowledge. Let Eleanor’s story serve as both a cautionary tale and a call to arms: Protect yourself, your family, and your finances. In the shadow of fraud, love need not be blind—it must be discerning.

Stay alert, stay critical, and never underestimate the cunning of those who would exploit the human heart.

Criminal Insights

“When I sell liquor, it's bootlegging. When my patrons serve it on a silver tray on Lakeshore Drive, it's hospitality.”

Al Capone was one of the most notorious figures in American organized crime during the Prohibition era. Known as “Scarface,” he built an empire around bootlegging, gambling, and racketeering, dominating Chicago's underworld with a combination of ruthless violence and calculated public relations. Capone’s organization operated like a shadow corporation, orchestrating an intricate network of illegal activities while maintaining a façade of philanthropy. Despite his infamy, it was his financial missteps—tax evasion—that ultimately brought him down, underscoring the power of bureaucracy in dismantling even the most formidable criminal empires.

“For a long time now I’ve been trying to figure out just what a racketeer is. I never went to school past the third grade, but I’ve graduated from ten universities of hard knocks, and I’ve decided that the definition of a racketeer is anyone who tries to accumulate wealth, power and prestige, at the expense of entrenched wealth, power and prestige.”

Frank Costello, often called the “Prime Minister of the Underworld,” was a pivotal figure in American organized crime during the mid-20th century. Renowned for his diplomatic approach, he shifted the Mafia's focus from brute force to political and economic influence. Costello wielded power behind the scenes, using his connections with politicians and law enforcement to shield his operations in gambling and racketeering. His ability to blend criminal enterprise with legitimate business and maintain a polished public image made him a trailblazer in organized crime, elevating the Mafia’s role in American society while avoiding the violent notoriety of his peers.

Timothy Dexter: The Accidental King of Chaos and Currency

There are lucky men, and then there’s Timothy Dexter—a man so cosmically fortunate that his life reads less like a biography and more like a farcical novel with the universe as his ghostwriter. Born in 1747 in Malden, Massachusetts, Dexter’s journey from tanner’s apprentice to self-declared “Lord” is an improbable cocktail of blind ambition, social ridicule, and baffling success. At the height of his eccentric reign, he managed to buy up 20% of all the U.S. Continental currency—yes, twenty percent of the nation’s money—and somehow turned that financial lunacy into a towering fortune. But Dexter was no Rockefeller. His legacy wasn’t built on genius, but on sheer audacity, timing, and the kind of luck that makes gods jealous.

The Making of Madness: From Tanner to Tycoon

Born to farm laborers, Dexter’s early life was a modest affair. He left school at the age of eight, which was probably a blessing given his lifelong disdain for grammar and punctuation. As a teenager, he apprenticed as a tanner, a noble trade involving leather and an ungodly amount of animal hides. But Dexter wasn’t content with scraping by—he craved the wealth and respect of New England’s social elite, despite being as polished as a pair of worn boots.

His first big “break” came when he married Elizabeth Frothingham, a wealthy widow ten years his senior. Whether this was love or an opportunistic business merger depends on who you ask. Either way, it moved Dexter into the upper crust of Newburyport, Massachusetts, and gave him just enough capital to launch his baffling career as one of America’s weirdest millionaires.

The Currency Conspiracy: Owning 20% of a Nation’s Debt

Dexter’s rise to fortune coincided with the economic chaos of the Revolutionary War. At the time, the Continental Congress was printing currency faster than modern meme stocks rise and fall. By the war’s end, the value of the Continental dollar had cratered to near worthlessness. Farmers burned it for fuel. Merchants used it as wallpaper. The phrase “not worth a Continental” became shorthand for abject uselessness.

Enter Timothy Dexter, who ignored the collective wisdom of literally everyone and bought up as much of this financial rubbish as he could find. Not just a little, mind you—Dexter acquired 20% of all Continental currency in circulation. His neighbors laughed, mocked, and likely placed bets on his impending bankruptcy. But Dexter remained undeterred. Whether through lunacy, divine intervention, or some mix of the two, his gamble paid off spectacularly. When the U.S. government announced plans to redeem the currency for treasury bonds at 1% of face value, Dexter became unfathomably rich overnight.

This was no stroke of genius; Dexter barely understood the mechanics of his own windfall. Yet in one reckless move, he had stumbled into controlling a significant chunk of the young nation's economy. His contemporaries, still smarting from their own prudence, must have ground their teeth to dust at the sight of Dexter’s rising star.

The Art of Doing Everything Wrong (Yet Succeeding)

Flush with newfound wealth, Dexter embarked on a spree of investments so absurd they seemed like an elaborate prank. Encouraged by rivals who found his success insufferable, Dexter took their sarcastic advice and made it literal.

Coal to Newcastle: In what should have been financial suicide, Dexter shipped coal to Newcastle, England—Europe’s coal capital. The timing? Immaculate. His shipment arrived during a miners’ strike, and he sold out at premium prices.

Bed Warmers to the Tropics: Dexter sent bed warmers to the sweltering West Indies, a move so nonsensical it bordered on performance art. But plantation owners repurposed them as molasses ladles, turning Dexter another profit.

Cats to the Caribbean: In an act of what can only be described as divine trolling, Dexter gathered Newburyport’s stray cats and shipped them to the Caribbean. Luckily for him, a rat infestation was wreaking havoc on sugar plantations. The cats were welcomed as furry heroes.

Gloves to Guinea: Told to ship wool gloves to the tropical region of Guinea, Dexter once again seemed doomed. Yet Portuguese sailors on their way to Siberia bought his entire stock for the harsh northern winters.

His Highness, Lord Timothy Dexter of Ridicule

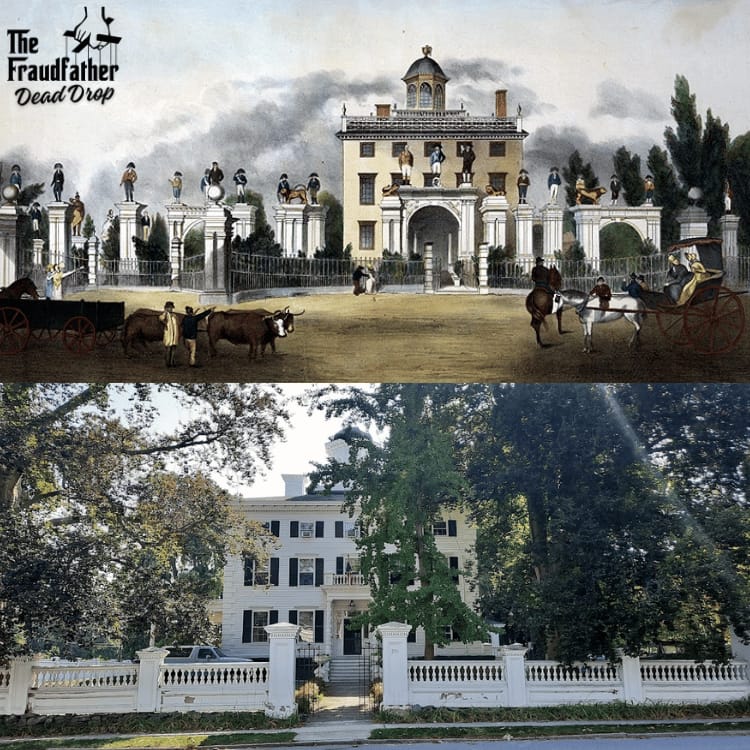

Dexter didn’t just want to be wealthy—he wanted to be revered. But respect among New England’s elite wasn’t something you could buy, and Dexter’s brash manners, wild schemes, and drunken eccentricities made him the laughingstock of the region. Undeterred, he doubled down on his delusions of grandeur, styling himself as “Lord Timothy Dexter” and building a mansion so ostentatious it practically screamed, “Look at me, peasants!”

The pièce de résistance of Dexter’s estate was its front yard, populated by 40 colossal wooden statues of historical figures—including George Washington, Thomas Jefferson, and, naturally, Dexter himself. Beneath his own statue, he inscribed: “I am the first in the East, the first in the West, and the greatest philosopher in the Western world.” The New England elites were not impressed.

Punctuating Madness: A Memoir Without Punctuation

Dexter, ever the enigma, decided to solidify his legacy by penning a memoir: A Pickle for the Knowing Ones. The book contained no punctuation, haphazard capitalization, and a liberal disregard for spelling. Critics, predictably, mocked it. Dexter’s response? He added an entire page of random punctuation marks in the second edition, instructing readers to “sprinkle them in as they saw fit.”

Bizarrely, the book became a bestseller. Perhaps people couldn’t look away from the literary equivalent of a train wreck, or maybe Dexter’s brand of lunacy was just what the world needed.

The Fake Funeral: Attention at Any Cost

In one of his most infamous stunts, Dexter staged his own funeral just to see how many people would mourn him. Over 3,000 attendees came, which delighted him—until he noticed that his wife wasn’t crying convincingly enough. Enraged, Dexter leapt out of his coffin mid-funeral and berated her in front of the crowd. Because why not?

Fraudfather’s Note: Dexter and the Laws of Power

Timothy Dexter’s life is a textbook example of Robert Green’s The 48 Laws of Power—even if he stumbled into them unwittingly:

Law 6: Court Attention at All Costs

From his ridiculous investments to his punctuation-free book, Dexter ensured that people couldn’t stop talking about him. Even ridicule served his purposes.

Law 10: Infection – Avoid the Unhappy and Unlucky

Dexter’s neighbors tried to infect him with their bad advice, but he turned their schemes into gold. He thrived on the failures of others.

Law 28: Enter Action with Boldness

Dexter never hesitated. His absurd ventures—coal to Newcastle, bed warmers to the tropics—were executed with such audacity that they somehow worked.

Law 31: Control the Options

Dexter’s unpredictability kept his rivals on their heels. Every time they thought they’d outsmarted him, he turned their sabotage into success.

Law 38: Think as You Like but Behave Like Others

Dexter flouted this law magnificently. He behaved however he pleased, and somehow, the world bent to his madness.

The Legacy of Lunacy

Timothy Dexter didn’t just stumble into wealth; he bulldozed into it with reckless abandon and left a legacy of chaos that’s impossible to replicate. His story is a reminder that success sometimes rewards the bold, the lucky, and the unapologetically absurd. In the end, Dexter wasn’t just the luckiest man alive—he was the Fraudfather of his time, proving that audacity and timing can conquer even the harshest odds.

About The Fraudfather

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.

This newsletter is for informational purposes only and promotes ethical and legal practices.