- The Fraudfather's Dead Drop

- Posts

- Is Unemployment In Your Future?

Is Unemployment In Your Future?

How sophisticated scammers are exploiting the job market crisis with fake recruiters, fraudulent interviews, and elaborate schemes designed to steal from desperate Americans searching for work.

GM, Welcome Back to the Dead Drop.

It is often said that the first casualty of war is truth. However, there are also some universal truths that often comes with war zones and one of them is that desperation is the world's most effective recruitment tool. When people feel cornered, when their backs are against the wall, they make decisions they'd never make in calmer times. Some become victims. Others become perpetrators. And right now, we're watching both sides of that equation explode simultaneously.

The Economic Pressure Cooker

Let me give you the numbers, because they tell a story that should make every security-conscious person sit up and pay attention.

So far in 2025, companies have announced 946,426 job cuts. This is the highest year-to-date total since 2020, according to the Challenger report (the US Government is shutdown, so no BLS numbers.) That's a 55% increase compared to the same period last year. We're on track to surpass a million announced layoffs for the first time since 2020, and the Challenger report notes that previous periods with this many job cuts occurred either during recessions or during periods of transformative technology.

The labor market metrics paint an even grimmer picture. There's now less than one job opening for every unemployed worker, marking the worst labor market conditions since before the pandemic. For context, between one to 1.5 job openings per unemployed worker is considered normal and balanced. Above 1.5 is considered a tight labor market where employers compete for talent. Below one? That's considered high slack and a recessionary environment. We're trending downward, fast.

The ADP report shows the private sector lost 32,000 jobs in September. This represents the biggest decline in two and a half years. The Federal Reserve is responding with aggressive rate cuts, with a 96.2% probability of another cut at their October 29th meeting, because they're watching the same deterioration I am. They're trying to revive an economy that's showing clear signs of distress.

But here's what the economic reports don't tell you: every one of those 946,000+ job cuts represents a potential fraud victim. Or a potential fraudster. Sometimes both.

The Fraud Explosion Nobody's Talking About

During my years investigating financial crimes around the world, I learned that criminals rarely create opportunities. They exploit them. And right now, they're feasting on human desperation at industrial scale.

Job scam complaints surged by 1,000% from May through July 2025, according to research by BrokerChooser analyzing Federal Trade Commission data. Read that again. Not 100%. One thousand percent. Employment scams now rank as the fourth most common fraud reported to the FTC, and nearly one in three Americans report receiving job offer scams via text message. These schemes have moved beyond email into our daily conversations, embedding themselves in the communication channels we trust most.

The financial damage is staggering. Between the first and second quarters of 2025, 75,364 people fell victim to job scams, suffering an average loss of $2,100 per victim. That totals approximately $157 million in financial losses. And that's just what's been reported. Based on my experience investigating fraud rings, the actual numbers are likely three to five times higher. Most victims never report. Shame, embarrassment, or simply not knowing where to report keeps the true scale hidden.

McAfee's research shows victims lost an average of $1,471 per scam in 2024, with $12 billion reported lost to fraud last year. That's a 21% increase compared to the previous year. The National Cybersecurity Alliance describes what we're witnessing as "a perfect storm of factors." A tight labor market where more people are urgently competing for fewer opportunities creates pressure that scammers exploit.

The unemployment fraud sector has exploded alongside job scams. Fraudsters are now targeting unemployment benefits claimants with sophisticated fake letters that appear to be official state notices demanding payment on liens or debts, attempting to harvest banking information. They're hitting people when they're already down, exploiting government processes that victims assume are legitimate because they're scared and vulnerable.

The Historical Pattern: Why This Was Inevitable

This isn't new. It's predictable. And that's what makes it so dangerous that so few people are prepared.

During the 2008-2009 recession, the Association of Certified Fraud Examiners conducted a comprehensive survey of fraud experts that should have served as a warning for exactly what we're experiencing now. Their study found that 55.4% of fraud experts reported fraud levels significantly increased during the economic crisis, with nearly half citing increased financial pressure as the biggest contributing factor. Layoffs were pervasive and left holes in organizations' internal control systems, creating both motivation and opportunity for fraud.

At the height of that recession in 2009, the FBI's Internet Crime Complaint Center received 336,655 complaints of online crime. This represented a 22.3% increase from the previous year. Total monetary losses were reported at $559.7 million, more than double those of 2008. Then came 2020 and the pandemic. The number of online crime complaints shot up to 791,790, a 69.4% increase from 2019. Total monetary losses exceeded $4.2 billion, a 20% increase from the previous year.

By 2022, as economic conditions deteriorated, estimated losses hit $10.47 billion. That's a 50% increase as the economic landscape entered recession territory. The pattern is undeniable: economic hardship and fraud are inextricably linked.

Here's the operational reality: during economic downturns, opportunities for fraud multiply as workforce cuts eliminate internal controls. Companies desperate to survive slash budgets, often cutting cybersecurity and fraud prevention departments first. Middle management gets laid off. These are typically the people serving as the first line of defense for detecting fraud. As one fraud investigation partner at KPMG noted during the UK's early 1990s recession, "when that layer's removed, you've eroded your internal processes which are there to control fraud."

Meanwhile, financial pressures push otherwise honest people past their breaking points. I've interviewed enough fraudsters to confirm this pattern. When someone's choosing between feeding their family and staying on the right side of the law, the law often loses. According to survey data from British insurer RSA, 3% of adult Britons said hard economic times made committing insurance fraud more acceptable. That's rationalization in action. It's the third element of the fraud triangle alongside motivation and opportunity.

The AI Accelerant: Force Multiplier for Fraud

But this cycle is fundamentally different from 2008 or even 2020. This time, criminals have a force multiplier that didn't exist during previous recessions: artificial intelligence.

Generative AI has made it easier for bad actors to craft convincing fake job postings, recruiter profiles, and even interview scripts that feel completely legitimate. I've reviewed some of these AI-generated scam operations as part of ongoing investigations. They're frighteningly sophisticated. Professional email addresses mimicking real companies. Polished websites that pass casual inspection. Multi-round interview processes complete with video calls featuring AI-generated or deepfaked "recruiters." Documents that look identical to legitimate offer letters.

The criminals I used to chase had to manually craft each scam, limiting their reach. Now they can generate thousands of personalized, convincing fraud attempts in hours. Scale meets sophistication, and the results are devastating. Gartner's 2025 survey of 3,000 job candidates found that 6% admitted to engaging in interview fraud. Either they impersonated someone else or had someone pose as them. Their prediction? By 2028, one in four candidate profiles may be fake.

The FBI has warned about North Korean scammers posing as Americans to gain fraudulent employment and access to U.S. company networks. This isn't just fraud. It's espionage and national security threat packaged as employment scams.

The Mechanics of Modern Employment Fraud

The sophistication of these operations would impress even seasoned investigators. Here's how they work:

Fake remote job offers dominate, requesting upfront payments for equipment, background checks, or training that never materializes. Phishing recruitment emails appear to come from real companies, asking job seekers to provide sensitive personal details like Social Security numbers or banking information. AI-generated job listings create fraudulent but professional-looking descriptions and websites that lead to fake application portals designed to harvest data.

The fake check scam remains brutally effective. The FTC recently warned consumers about fraudsters posing as employers who send counterfeit checks, instructing victims to purchase equipment from selected vendors. The victim deposits the check, sends money to the "vendor" (actually the scammer), and then discovers days later that the check was fake. They're on the hook for the full amount while the criminal keeps the real money they sent.

Money laundering recruitment has evolved. Scammers post job ads on legitimate employment websites or social media, recruiting desperate job seekers to open bank accounts or use existing accounts to transfer funds. The recruited person receives a fee for the "service," never realizing they're now complicit in money laundering until law enforcement comes calling.

Credit report verification scams trick victims into paying for unnecessary reports while revealing personal information. The fraudulent employer claims they need a credit check, promises to refund the cost, and then vanishes with both the payment and the data harvested from the victim.

Why Your Risk Has Never Been Higher

Financial loss is just the beginning. Identity theft, compromised credentials, damaged credit, even criminal liability for unwittingly participating in money laundering. The cascading consequences can take years to resolve and cost tens of thousands to fix.

The most dangerous aspect? These scams target people at their most vulnerable moments. Someone who's been job hunting for months, watching their savings dwindle, seeing their family stressed. They want to believe the opportunity is real. Their critical thinking is compromised by desperation and hope. That's exactly the psychological state criminals engineer and exploit.

The current economic environment creates perfect hunting conditions for fraudsters. According to BrokerChooser's analysis, there were nearly 700,000 job cuts in just the first half of 2025. That's roughly an 80% increase in layoffs compared to the same timeframe last year. Every person affected becomes a potential target.

The Fraudfather Bottom Line

We're in a perfect storm: the worst labor market in years, record-breaking job losses approaching a million announced cuts, sophisticated AI-powered fraud tools that can generate convincing scams at scale, and historically proven patterns of recession-driven crime surges. The criminals understand what's happening. They've studied the same economic reports I have. They know exactly who's vulnerable and why.

What they're banking on is that you don't know what they know. That you won't recognize the warning signs until it's too late. That desperation will override your instincts. That you'll rationalize away the red flags because you need the opportunity to be real.

During my years hunting these predators, I learned that the best defense against fraud isn't just vigilance. It's understanding the operational environment that breeds it. Right now, that environment is more conducive to fraud than at any point since 2020. The economic pressures are real. The job market is genuinely brutal. And criminals are weaponizing both facts to separate you from your money, your identity, and your security.

That changes today. Because forewarned is forearmed.

Got a Second? The Dead Drop reaches 4,700+ readers every week including security professionals, executives, and anyone serious about understanding systemic wealth transfers. Know someone who needs this intelligence? Forward this newsletter.

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

The Fraudfather's take on the week's biggest scams, schemes, and financial felonies, with the insider perspective that cuts through the noise.

Three text messages landed on my phone this week. Three different scams. Three psychological ploys designed to exploit the exact vulnerability that's keeping millions of Americans awake at night: economic uncertainty.

Let me show you what professional fraud looks like in 2025.

The Criminal Evolution: Why Your Phone Won't Stop Buzzing

Job scam texts have exploded. The Federal Trade Commission reports these schemes have tripled from 2020 to 2024, with over 235,000 text message scams reported in just the first half of 2025 alone, resulting in $342 million in losses. But here's what keeps me up at night: only 4.8 percent of fraud victims ever report to a government entity, which means the real numbers are catastrophically higher.

Losses from text job scams jumped from $14.8 million in 2023 to $61.2 million in 2024. That's a 313% increase in twelve months. This isn't random. This is industrialized fraud operating at scale.

Employment-related scams jumped by over 1,000 percent from May through July, the exact period when new graduates flood the job market. Nearly 1 in 3 Americans now report receiving job offer scams via text message. The average victim loses $1,471 per scam, with $12 billion reported lost to fraud last year alone, a 21 percent increase year-over-year.

The three screenshots I'm sharing today represent three distinct attack vectors, each one psychologically calibrated for maximum impact.

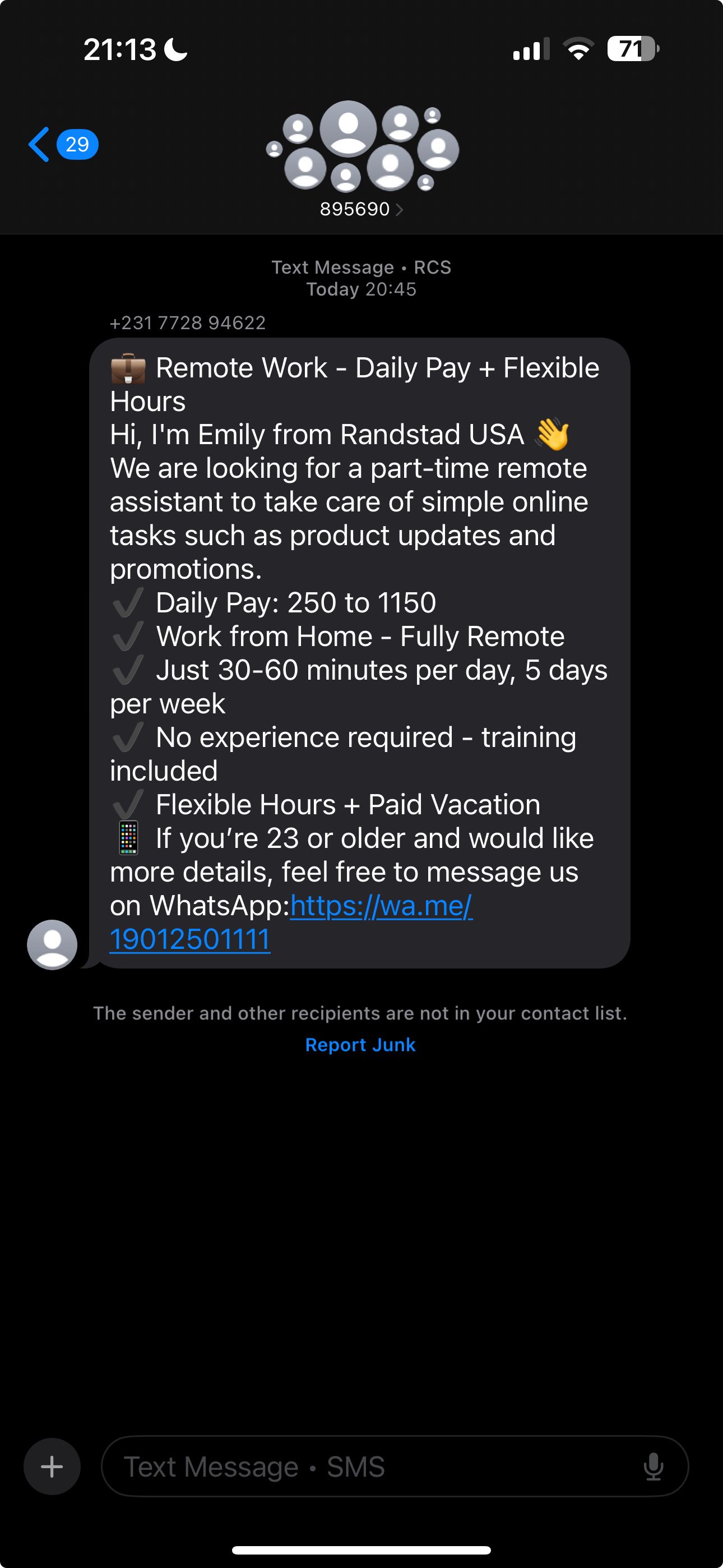

Message One: The "Randstad USA" Remote Work Scam

"Hi, I'm Emily from Randstad USA 👋 We are looking for a part-time remote assistant to take care of simple online tasks such as product updates and promotions."

Daily pay: $250 to $1150. Work from home. Just 30-60 minutes per day. No experience required.

Notice the sophistication here. Randstad is a legitimate multinational staffing company with actual brand recognition. The criminals aren't pretending to be some unknown startup; they're hijacking established credibility. The pay range is deliberately absurd ($250-$1150 for 30 minutes of work?) but it's wrapped in just enough legitimacy to bypass your initial skepticism.

The WhatsApp redirect is the tell. Legitimate companies like Indeed and major staffing firms never reach out via text to offer employment, and they certainly don't move conversations to WhatsApp or Telegram. The moment they ask you to leave the verified communication channel, you're entering the kill zone.

Message Two: The "Amazon Refund" Hook

"We're reaching out to let you know that you're eligible for a full refund for one of your recent orders... you do not need to return the item to receive your refund."

This one's particularly insidious because it doesn't look like a job scam at all; it's a classic refund fraud that preys on confusion and urgency. The shortened URL is designed to bypass your mental defenses by looking like a legitimate link tracking system.

Here's the operational reality: Amazon will never notify you of a refund via unsolicited text message from an unverified international number (+62 is Indonesia). They communicate through your Amazon account message center, period.

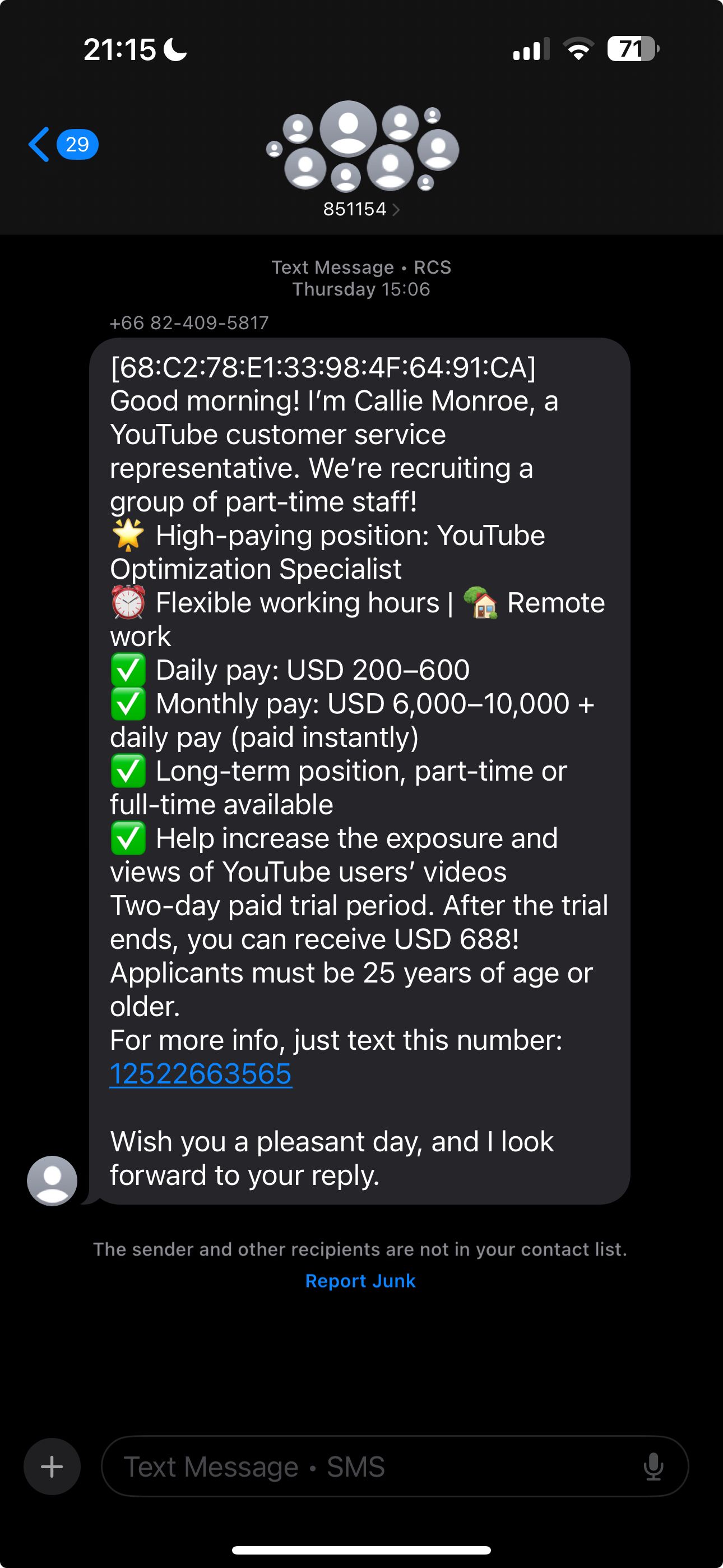

Message Three: The "YouTube Optimization Specialist" Fantasy

"High-paying position: YouTube Optimization Specialist... Daily pay: USD 200-600... Monthly pay: USD 6,000-10,000 + daily pay (paid instantly)."

This is what the FTC calls a "task scam," schemes where victims are promised payment for simple digital tasks like boosting streaming numbers or engagement metrics. These scams saw reports jump from 5,000 in 2023 to 20,000 in just the first six months of 2024, with losses exceeding $220 million.

The criminal psychology here is brilliant. They're offering $688 for a two-day trial period, creating immediate gratification to build trust. The scam works in phases: first you complete simple tasks and see small payments, building trust. Then they introduce "bundles" where your account gets "stuck" and you need to send money, often via cryptocurrency, to "unlock" your earnings. The amounts start small ($18 in Bitcoin to bridge an $85 to $100 gap) and escalate rapidly ($350 to unlock your account).

The Long Con: When Two Weeks of Interviews Means Nothing

But here's what really concerns me: these text message scams are just the visible tip of a much more sophisticated operation.

Let me tell you about Nicole Becker (not her real name), a 37-year-old communications professional in Oregon. She went through two weeks of interviews with what appeared to be a legitimate Chinese sportswear brand. An initial online interview with HR. A follow-up call with the supposed head of marketing and sales. No red flags. No obvious tells.

Then came the offer letter, accompanied by a detailed PowerPoint presentation outlining her assigned role, budget, and performance targets for the first six months. Both parties signed the agreement. She was in. She had the job.

A week later, during the onboarding meeting, they told her the company's servers had been destroyed in California's wildfires. She would need to purchase a laptop and cellphone from a designated retailer herself, with the promise of reimbursement in her first paycheck.

"That's when my heart sank and I was like, 'oh no, I fell for a fake job,'" Becker said. "It is so scary because I consider myself to be a smart and clued-in person, especially with what's going on with AI and scams in general. If I can get scammed, I feel this can happen to anybody."

This is the evolution. This is what keeps me awake at night.

The Criminal Playbook: Why This Works

Fraudsters have become remarkably sophisticated, spoofing legitimate businesses, using actual HR managers' names, and timing their attacks to coincide with real job postings on company websites. They're not just sending random spam anymore; they're conducting reconnaissance.

The economic context amplifies everything. We're seeing what cybersecurity experts call a "perfect storm": a tight labor market where more people are urgently competing for fewer opportunities creates pressure that scammers exploit ruthlessly. At the same time, generative AI has made it easier for criminals to craft convincing fake postings, recruiter profiles, and even interview scripts.

AI has made these scams exponentially more effective, allowing bots to handle initial conversations with perfect grammar and natural language, then handing off to human operators to close the deal and extract money.

The Federal Trade Commission recently warned consumers about "fake check scams," where fraudsters pose as employers and send counterfeit checks, instructing victims to purchase equipment from selected vendors. If you receive an offer that includes depositing a check and then using some of the money for any reason, that's a scam. Walk away immediately.

The Other Side of the Coin: Employers Under Attack

The threat runs both directions. In July, the FBI warned about North Korean scammers posing as Americans to gain fraudulent employment and access to US company networks. This isn't just about stealing money from job seekers; it's about penetrating corporate infrastructure.

A recent Gartner survey of 3,000 job candidates found that 6 percent admitted to engaging in interview fraud, either by impersonating someone else or having someone pose as them. The firm estimates that by 2028, one in four candidate profiles worldwide will be fake.

Think about that for a moment. By 2028, which is only three years away, one in every four resumes you review could be completely fraudulent.

The Fraudfather Bottom Line

These aren't isolated incidents. This is coordinated, international fraud infrastructure. Many of these operations run from overseas scam farms, large-scale operations in the developing world where barely remunerated workers execute thousands of fraud attempts daily.

The three messages I received this week? They came from Liberia (+231), Indonesia (+62), and Thailand (+66). Different continents. Same playbook.

Nicole Becker went through two weeks of professional interviews before discovering the truth. If someone that careful, that intelligent, that clued-in can fall for this, anyone can.

Your Defensive Protocol:

X No legitimate employer recruits via unsolicited text message

X No real company asks you to continue conversations on WhatsApp, Telegram, or WeChat

X No authentic job requires you to send money via cryptocurrency to "unlock" earnings

X No legitimate company asks you to buy equipment before your first paycheck

X No real employer sends you a check and asks you to purchase from specific vendors

✓ Verify every opportunity through the company's official website

✓ Search "[Company Name] + scam" before engaging

✓ Trust your instincts: if the pay seems impossible, it is

✓ If asked to purchase equipment before employment, it's fraud

✓ Report suspicious texts to 7726 (SPAM) immediately

The most dangerous criminal

s aren't the ones who threaten you; they're the ones who understand exactly what you need to hear when you're worried about making rent, when you're between jobs, when you're scared about the economy.

Stay sharp. Trust slowly. Verify everything.

The Fraudfather

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

This newsletter is for informational purposes only and promotes ethical and legal practices.