- The Fraudfather's Dead Drop

- Posts

- The Meltup is Coming. Your Cash is a Liability.

The Meltup is Coming. Your Cash is a Liability.

They're printing the money. You're holding the bag. Learn how to fortify your assets against the inevitable.

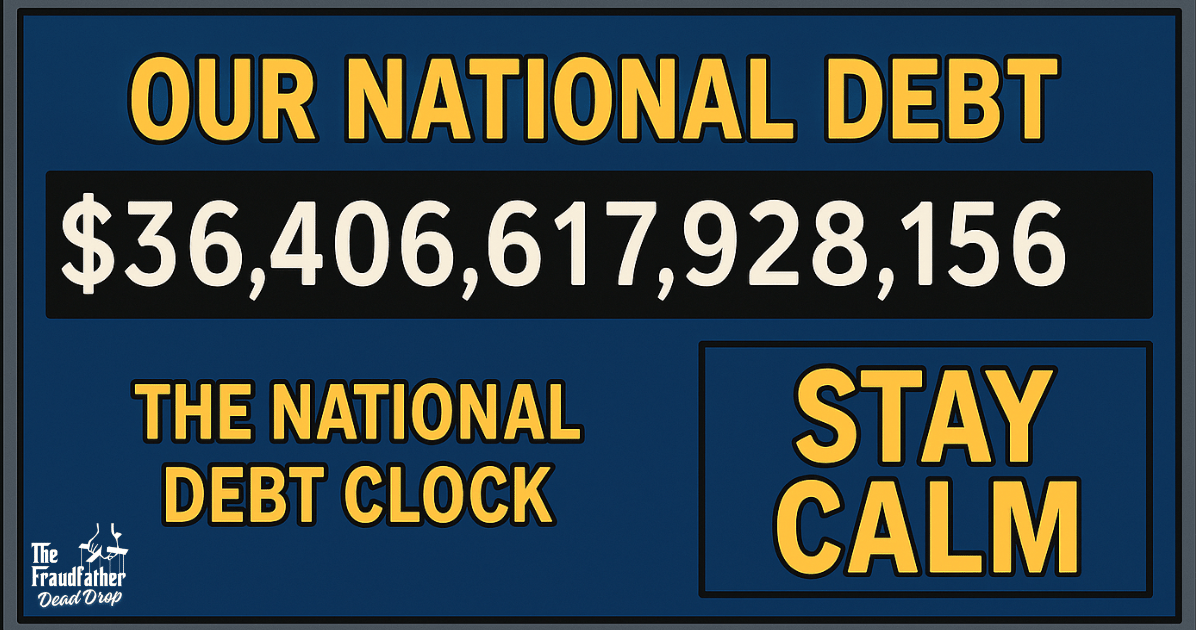

$36 Trillion Is Only The Beginning…

They tell you the economy is "stable." They point to the metrics, the headlines, the carefully curated narratives. They lie. The current calm is a strategic deception, a calculated pause before a re-acceleration that will fundamentally re-architect wealth. This isn't a forecast; it's a tactical warning.

The $36 Trillion Fuse: The Coming Inflationary Inferno.

Forget the "Great Recession." Prepare for the Great Meltup. It is not a possibility; it is an inevitability. The fuse is the U.S. federal government's national debt, now spiraling beyond $36 trillion and accelerating exponentially. This isn't a crisis of mismanagement; it's a deliberate, engineered trap.

$36 Trillion of Debt is Just the Beginning…

The Fed’s own Treasury charts confirm the trajectory: a vertical ascent of debt that defies all historical precedent. The interest payments alone are a trillion-dollar black hole, a fiscal cancer consuming 20% of all tax revenue. This system is not merely unsustainable; it is a house of cards built on borrowed time, designed to collapse in a manner most advantageous to its architects.

They will tell you the solution lies in cutting spending. A cynical joke. To balance the budget would require gutting Social Security, Medicare, national defense, a political suicide mission no regime will undertake. The government, the nation's largest employer, cannot afford the resulting recession; falling tax revenue would only accelerate the death spiral. Deflation, for them, is a self-inflicted wound, a reset button the elite will never press on a game they are currently winning.

The Play: They have exhausted all good options. Only bad ones remain. And the best bad option for the Uber-rich and the political class is hyperinflation.

Why It Works: The Elite's Advantage – The Silent Tax.

Inflation is the ultimate solvent for unpayable debt. A $300,000 mortgage becomes a trivial sum when your income inflates (even if it lags). For the government, their $36 trillion debt becomes a manageable phantom, its real burden evaporating with each newly printed dollar.

But more critically, inflation is the elite's ultimate wealth transfer mechanism. When the central banks print trillions, that new currency is not distributed equally. You, the average citizen, get crumbs… a $1,200 stimulus check. They, the connected, get millions in ERC tax credits or multi-million-dollar PPP loans. They receive first access to the newly created currency, deploying it into hard assets, real estate, equities, commodities, before its purchasing power dilutes. Your hard-earned savings, held in cash, become a melting ice cube, a slow bleed, a silent tax that steals your future without a single legislative vote. While your cash loses value, their assets soar. The wealth inequality gap widens into a chasm, separating the asset-rich from the cash-poor.

The Illusion: The CPI's Deceptive Whisper.

They are pointing to the current CPI of 2.3% (April 2025) and whispering "transitory." This is the most dangerous form of deception. This is the calm before the storm. The trajectory of government spending versus revenue is clear: deficits will continue. Regardless of who occupies the White House—Republican or Democrat—the spending will escalate. The debt will climb.

This isn't doomsday prophecy; it's a predictable consequence of engineered fiscal irresponsibility.

The Counter: Asset Fortification – Your Survival Play.

You cannot afford to be caught holding too much cash. It is not a store of value; it is a depreciating liability in this coming environment. This is not about getting rich; it's about survival, about protecting what you have.

Real Estate: Acquire your primary residence. A fixed-rate mortgage becomes a strategic asset in an inflationary environment. Your debt shrinks in real terms; your shelter cost is fixed, while rents for the unprepared explode. This is not a luxury; it's a defensive position.

Equities: Ride the wave. Get strategically invested in the stock market. It's not about beating inflation; it's about not falling behind. The market, however volatile, is where the newly printed capital flows first.

Hard Assets: Gold, silver, commodities. Physical or via market instruments. These are the ancient shields against currency debasement, the ultimate hedge when fiat loses its faith.

Crypto: Understand its dual nature as both a speculative asset and a potential hedge. Strategic exposure to decentralized assets can offer a tactical escape route from traditional financial system vulnerabilities. (also subscribe to The KillChain 😉 )

The Great Meltup is coming. Probably 2026, possibly sooner. The standard of living for the unprepared will plummet. Do not be fooled by the current numbers. This is not a conspiracy theory; it's a predictable consequence of a system designed to protect itself at your expense.

Dead Drop Summary:

U.S. national debt > $36 trillion, accelerating exponentially, creating an unsustainable fiscal trajectory.

Political reality dictates continued deficits; massive spending cuts are a non-starter.

Hyperinflation is the "best bad option" for the elite and government, serving as a silent debt jubilee.

Holding cash is a strategic error: it's a melting ice cube, a silent tax that transfers wealth from the cash-poor to the asset-rich.

Current CPI of 2.3% is a deceptive calm; inflation will re-accelerate hard.

Action: Fortify wealth in hard assets (real estate, equities, crypto, commodities) to survive and potentially thrive in the coming "Great Meltup."

Introducing The KillChain

P.S. If you're serious about understanding how fraud actually happens in the crypto economy, The KillChain is essential reading. This weekly tactical brief dissects the dark mechanics of on-chain scams, off-chain exploits, and stablecoin sleight of hand with surgical precision. Packed with battlefield insights and compliance-warfare strategy, it’s your front-row seat to the new era of financial deception, and the playbook to beat it. Subscribe here: The KillChain

📞 Need a fraud overhaul? Book a Call with the Fraudfather!

“They print the money, you pay the price. Unless you learn to print your own.”

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

120-Second Spy: The Dark Empath – When Understanding Becomes a Weapon

The Echo in the Void: How Your Deepest Needs Are Turned Against You.

The Tactic: The Dark Empath's Blade.

Forget the loud narcissist. The true predator operates in the shadows of your trust. This is the Dark Empath: an individual with an uncanny ability to understand and even feel your emotions, but who possesses zero moral or compassionate restraint. Their empathy isn't about connection; it's about reconnaissance. They map your insecurities, your unfulfilled desires, your past traumas, not to heal, but to exploit. They mirror your pain to gain access, then weaponize that intimate knowledge to control, manipulate, and extract. Their empathy is cognitive, not affective, but a highly sophisticated intel-gathering operation.

Why It Works: The Craving to Be Seen.

Humans are hardwired to crave understanding. When someone truly "gets" your silent struggles, your unspoken ambitions, or your specific vulnerabilities, it triggers a powerful, unconscious sense of recognition and relief. "Finally," your psychology whispers, "someone sees me." This bypasses logical defenses, hitting the emotional core, rapidly lowering defenses and generating a potent, if fragile, sense of trust and intimacy. The Dark Empath provides the perfect echo of your inner void, making you feel profoundly seen and validated. This perceived empathy overrides critical thought, forging a dependency rooted in false understanding. You are drawn not to their virtue, but to the feeling of being profoundly understood, a feeling they carefully engineered.

Dark Lesson from History: The Mesmerist's Grip.

Consider figures like Jim Jones. He didn't initially preach a doomsday doctrine. He preached social justice, racial equality, and community. He possessed an almost supernatural ability to identify the deep-seated grievances, the yearning for belonging, and the unspoken traumas of his flock. He would spend hours with individuals, mirroring their pain, articulating their unseen wounds, and presenting himself as the only one who truly understood their suffering and offered a path to redemption. This wasn't genuine compassion; it was a calculated empathy that allowed him to forge immediate, intense emotional bonds, creating an unshakeable dependency rooted in perceived empathy. The doctrine followed; the emotional capture came first.

Tradecraft Hacks: Deploy or Defend.

Emotional Command (Defense): When someone seems to "get" you too quickly, too perfectly, particularly in a new relationship or high-stakes scenario, raise your internal threat assessment. Genuine understanding is built over time; instant resonance can be engineered.

Vulnerability Mapping (Defense): Identify your own "scars," your core insecurities, deepest desires, or unfulfilled needs. These are the weak points a Dark Empath will seek to exploit. Knowing them is the first step to defending them.

The Empathy Test (Defense): Observe if their "empathy" extends beyond understanding your feelings to genuine concern for your well-being, especially when it costs them something. Does their understanding translate to action that benefits you, or only to information that benefits their control? True empathy seeks to alleviate; dark empathy seeks to leverage.

Countermeasure: See the Strings, Not the Puppet Master.

Assume everyone is performing. The most convincing performances exploit your deepest emotional hungers. Don't confuse calculated understanding with genuine connection.

Analyze the Play: What emotional void are they attempting to fill for you? What deep-seated need are they mirroring?

Seek Consistent Reciprocity: True emotional investment is two-way. Are they equally vulnerable, equally giving, or is the flow always towards their benefit?

Value Action Over Affect: Does their perceived empathy translate into consistent, verifiable actions that genuinely support your well-being, or is it merely a powerful emotional display designed to disarm? The best actors make you believe the lie by making you feel the truth.

Life isn't a confessional. It's a stage where emotional currency is constantly being exchanged. Make sure you're reading the script, not just acting out someone else's part. Stay Dangerous.

Dead Drop Summary:

The Dark Empath uses cognitive empathy as an intelligence-gathering tool, mapping vulnerabilities for control and extraction.

They exploit the human craving to be "seen" and understood, creating false intimacy that bypasses logical defenses.

Emotional mirroring and understanding are weaponized to build dependency, as seen in historical manipulators like cult leaders.

Recognize calculated empathy: it's instant, often one-sided, and primarily serves the manipulator's agenda.

Defend by identifying your own vulnerabilities and demanding consistent, reciprocal action over mere emotional display.

“You're not stuck. You're just committed to certain patterns of behavior because they helped you in the past. Now those behaviors have become more harmful than helpful... Change the formula to get a different result.”

They say youth is wasted on the young. Sometimes, so is genius.

The King Greavys Playbook: How a $263 Million Crypto Empire Collapsed on Hubris and a Screen Recording

They say youth is wasted on the young. Sometimes, so is genius.

Just ask Malone Lam. At 20 years old, this Singaporean kid allegedly masterminded a crime ring that raked in over $263 million in cryptocurrency through social engineering and home invasions. He was "King Greavys," "Anne Hathaway," a digital phantom with a plan. But for all his calculated moves, his downfall wasn't a tactical genius or a complex sting. It was a damn selfie, a squishmallow, and the oldest enemy in the game: predictable human nature.

This isn't just a tale of grand larceny. It's a raw lesson in the critical vulnerabilities that lie even within the most sophisticated plays.

The Setup: A Digital Syndicate and the Art of the Double Call

Born from online gaming friendships, Lam and his alleged co-organizer, Conor Flansburg, built a syndicate that operated from October 2023 to March 2025. This wasn't just a few kids; it was a structured enterprise: database hackers, target identifiers, callers, money launderers, and burglars. Each piece of the machine knew its role.

Their specialty? The "social engineering enterprise." They were digital con artists, but with a physical backup plan. After profiling targets for "substantial virtual currency holdings," they'd launch a two-stage psychological assault:

Stage 1: The Scare. A fake "support" call, posing as a major crypto exchange or email provider, warning the victim their accounts were compromised. Simultaneously, their hackers pushed unauthorized notifications, making the threat feel chillingly real.

Stage 2: The Save. A second call, calm and reassuring, offering to "help" the panicked victim reset everything. The ultimate play: "Can you share your screen?" Boom! Private keys, master keys, login details – the keys to the digital vault exposed. In one notorious hit, they allegedly swept up 4,100 Bitcoin, worth $230 million at the time, from a single victim.

And if digital didn't work? If the targets held assets on physical devices? The syndicate would break into homes. In one case, a member traveled to New Mexico in July 2024, allegedly monitored by Lam via the victim's iCloud, to physically snatch hardware wallets. This was an operation that blurred the lines between cybercrime and old-school home invasion.

The Haul & The Hubris: Spending Like the World Was Ending

Once the crypto was snatched, it flowed through offshore exchanges, crypto mixers, and shell companies. Straw owners were set up for homes and exotic cars – the goal, one member messaged, was "to cover our tracks in a way that if anything comes back ever, we are covered and have no stress." They even shipped US$50,000 in cash inside a "squishmallow" stuffed toy between members. Communication was on encrypted apps, accounts regularly updated. They tried to be smart.

But the money, the sheer, unimaginable torrent of it, seemed to dissolve their discipline. The high life wasn't just lived; it was broadcast:

Luxury mansions in Miami, LA, the Hamptons (Lam's Miami rental alone was $68,000/month).

Private jets, private security.

Club bills topping $500,000 a night, buying branded handbags to give away, flashing luxury clothes and watches.

A fleet of 28 forfeited cars including seven Lamborghinis, four Porsches, three Rolls-Royces, and three Ferraris and one Lambo allegedly painted with Lam's name.

Even behind bars, Lam was allegedly instructing members to buy Hermes Birkin purses for his girlfriend, using stolen funds for his defense team.

This wasn't quiet accumulation. This was a supernova of conspicuous consumption, a financial explosion that could be seen from space.

The Cracks in the Facade: Echoes from the Edge

For all their calculated sophistication, their undoing wasn't a high-tech counter-operation. It was classic human folly, amplified by the very digital landscape they exploited. They received information from off-duty law enforcement officers about the investigation – insider intelligence, a tactical advantage that should have allowed them to vanish. Lam even allegedly dropped his phone into Biscayne Bay to destroy evidence.

But the high life, the flexing, the need for validation – those were the fatal flaws. While Lam was living out his Wolf of Wall Street fantasy, a different kind of operator was watching: ZachXBT, "Crypto's Batman." A self-proclaimed crypto vigilante, tracking crimes "for fun" after being scammed himself. He stalks the digital shadows, watching wallets, following trails.

The smoking gun? A screen recording of the group wildly celebrating their $230 million score. Accounts names visible. Voices matching social media. Someone sent that video to ZachXBT. That one slip, that moment of unchecked hubris, was enough.

One screen recording. One crypto vigilante. That's all it took to bring down a $263 million empire and see Malone Lam, at 20, facing 20 years in prison. He rejected a plea deal, apparently still playing the game from behind bars.

The Fraudfather’s Take: Lessons from the Lamb

This isn't just a story about a kid who made a bad choice. This is a masterclass in modern grift, human weakness, and the cold, hard rules of the game:

Hack: Discretion is the Ultimate Luxury. (The Cost of Flaunting). Lam’s crew were brilliant at the technical aspects of the grift, terrible at the operational security of staying free. Rapid, conspicuous consumption, especially of ill-gotten gains, broadcasts a signal louder than any wiretap. It attracts rivals, law enforcement, and vigilantes. If your goal is to keep the score, live like you didn't hit it.

Hack: Your Digital Footprint is Your Downfall. (The Echo of Hubris). Every flex, every celebration in a group chat, every social media post is a potential breadcrumb. The tools you use for connection can become instruments of your undoing. Assume everything you communicate, especially in celebration, will eventually be evidence. The smallest, most seemingly private digital indulgence can bring down the most sophisticated operation.

Hack: Define Your Exit Strategy (Beyond the Score). Lam mastered the take. He failed utterly at the keep. An exit strategy isn't just about laundering the money; it's about making yourself disappear from the game. Without a plan for how to live without drawing attention, how to reinvest, how to integrate the gains into a low-profile life, any score is just a ticking clock.

Hack: The Human Element is Always the Weakest Link. Lam’s technical brilliance, his organizational skill – all undone by the raw, predictable human need for validation, celebration, and luxury. Hubris, ego, and indiscretion are more potent weapons than any federal agency. Understand that your own impulses, or those of your associates, are the most dangerous vulnerabilities.

Hack: Trust No One (Especially the Source of Your Freedom). Information from "off-duty law enforcement" might feel like a lifeline, but it's a double-edged sword. Every piece of insider info comes at a cost, or is part of a larger play. Assume such intelligence is a test, a lure, or simply part of a bigger data collection effort.

Malone Lam proved you can, for a time, outrun the rules. But he also proved that you can't outrun human nature, especially when it's your own. His empire was built on exploiting the marks' predictable fear and trust. It collapsed because of the operators' own predictable hubris and a fatal desire to prove they were the king.

He's a "Crypto King" now, yes. But his throne is cold steel, and his crown is a mug shot.

📞 Book a Call with the Fraudfather! to fortify your defenses today!

Fresh Prints of Fraud: Who Got Caught, Who Got Paid, Who Got Played

Intel is only as powerful as the minds that wield it. If this Dead Drop sharpened yours, pass it along—because knowledge hoarded is power wasted. Share it now. 🚀📡

About The Fraudfather

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.

This newsletter is for informational purposes only and promotes ethical and legal practices.