- The Fraudfather's Dead Drop

- Posts

- The World's Burning: Don't Let Them Steal Your Reality.

The World's Burning: Don't Let Them Steal Your Reality.

How to Master the Frame in an Unhinged World.

How to Master the Frame in an Unhinged World.

Last week, we talked about life as a battlefield. This week, the battlefield just got a whole lot bigger. As the news cycles spin with reports of bombs dropping in Iran, it's a stark reminder that the world truly is in chaos. And in chaos, there's always cover for all matters of fraud schemes.

This isn't about fear; it's about frame control.

Because while the world feels like it's unraveling, the real danger isn't just physical. It's the unseen game playing out for your financial and psychological well-being. Fraudsters don't just deceive you; they hijack your reality. They build a frame, and you, unknowingly, step right into it.

This week, we're dissecting the "Invisible Cage"; how manipulators use frame control to turn your mind into their playground. We'll show you how they exploit your cultural programming, your emotional investments, and even your own logic to separate you from your money and your peace of mind. You'll learn the precise, repeatable tactics to not just survive, but to dominate the unseen game of psychological warfare.

Because failure isn't an option. It's a decision. And this is your playbook to ensure you're the one arranging the board, not just a piece on it.

In This Week’s Dead Drop:

“One of the fundamental findings of cognitive science is that people think in terms of frames and metaphors […] The frames are in the synapses of our brains, physically present in the form of neural circuitry. When the facts don’t fit the frames, the frames are kept and the facts ignored.”

The Invisible Cage: How Frame Control Turns Your Mind Into a Fraudster's Playground

The moment you realize you've been living in someone else's reality, it's already too late.

Fraud isn’t about deception. It’s about control. Specifically, frame control. You think you’re making your own decisions. You’re not. You’re making decisions inside a frame someone else built.

Take Sarah. A sharp, detail-obsessed accountant. For eight months, she sent money to “Marcus,” a U.S. soldier stationed overseas. She spotted the red flags, gift card requests, no video chats, stories that didn’t line up.

But none of that mattered. She wasn’t just being conned.

She was living inside Marcus’s frame.

In his frame, she wasn’t a victim.

She was a loyal partner.

Her logic wasn’t broken; her context was.

That’s how powerful frame control is: it doesn’t just manipulate what you believe. It reprograms how you interpret reality.

And if you don’t control the frame, someone else will.

Fraud doesn’t start with lies. It starts with frames.

The Three Invisible Prisons That Trap Your Mind

The Reality Hijack

Fraud doesn’t start with lies. It starts with frames.

Romance scammers don’t begin with financial asks. They build a reality:

“We’re in this together.”

“No one else understands us.”

“This distance is just temporary.”

By the time they ask for help, you're not making a financial decision, you're defending a relationship. Red flags get recast: Skeptical friends become villains. Refusal to video chat becomes a loyalty test. Doubt becomes betrayal.

You’re not irrational. You’re making logical decisions inside a false frame.

This is the “framing effect”: when the presentation, not the content, dictates your reaction. Fraudsters don't need to destroy your logic. They just need to distort the lens it looks through.

And that lens? Often shaped by culture.

A 2022 study in Frontiers in Psychology showed how cultural background influences framing susceptibility. Some cultures are more reactive to threat; others to opportunity. Your heritage, your operating system, can become your exploitable surface.

The Cultural Blind Spot

Your cultural values guide your decisions. But they also predict them, and that’s what makes them exploitable.

Fraudsters tailor scams based on this:

Prevention-focused cultures (East Asia, Middle East): Often value obligation, reputation, and family. Fraudsters use shame, duty, and fear of loss.

Promotion-focused cultures (U.S., Australia, Western Europe): Often value aspiration, independence, and gain. Fraudsters use urgency, exclusivity, and FOMO.

Same scam. Different bait.

“Don’t let your family down.”

“If you don’t act, you’ll miss the opportunity of a lifetime.”

Same scam.

Different frame.

Tailored to you.

And affinity fraud? That’s not just trust abuse, it’s cultural frame hijacking. Shared ethnicity, language, faith - all signal: “You’re safe here.” Fraudsters step into your cultural operating system and wear it like a disguise.

The Escalation Trap

Once you’re inside the frame, you start investing. Emotionally. Financially.

And every investment becomes a reason to keep going.

Sunk cost fallacy: “I’ve already spent $5,000.”

Cognitive dissonance: “Everyone warned me, but I have to prove them wrong.”

Social isolation: “They warned me about people who would try to ‘break us up.’”

Every payment deepens commitment. Every doubt becomes a test of loyalty. Every moment you don’t walk away strengthens the cage.

The fraudster doesn’t hold the door closed. You do.

The Dangerous Delusion That Makes You Vulnerable

Here’s the myth that leaves millions exposed: “Frame control is about confidence. Charisma. Knowing how to win arguments.”

No.

That’s amateur hour.

Real frame control is invisible. It’s the lens, not the content.

It doesn’t force you to believe anything.

It guides you to conclude it yourself.

And that’s why most people are sitting ducks. Because they’re focused on:

Defending their opinion.

Winning the debate.

Sounding smart.

Meanwhile, a skilled manipulator doesn’t care about your facts.

They care about your framing.

The Power of Owning the Frame

You don’t win by resisting a frame.

You win by choosing yours first.

Here’s what happens when you take back frame control

You Build Frame Immunity

You don’t get fooled. You see it coming.

You recognize:

The fast-tracked intimacy in romance scams.

The phony scarcity in financial scams.

The “only you can help me” pressure in family scams.

You spot frame tactics, not just red flags.

You Train Cultural Intelligence

You understand how fraudsters use your values against you, and you reverse it.

Ask:

“Am I responding to real need or cultural programming?”

“Would someone from a different culture see this as odd?”

“Is this urgency authentic, or tailored to my worldview?”

Self-awareness becomes your armor.

You Establish Reality Anchors

No one can hijack your mind if you’ve already planted anchors:

“I never make financial decisions in emotional states.”

“Anyone who pressures me doesn’t have my best interest at heart.”

“I verify before I trust. Always.”

You build your rules before the manipulation begins.

And that makes you unshakeable.

The Shield: Frame Awareness as Fraud Immunity

Mastering frame control isn’t about arguing better.

It’s about not entering the wrong story to begin with.

Here’s how to build real immunity:

Pattern Recognition

Fraudsters follow scripts:

Romance scams: Fast intimacy → future promises → emotional tests

Investment scams: Credibility signals → scarcity → pressure + jargon

Learn the patterns and you don’t need to fight them; you spot them early.

Emotional Distance

Frame awareness doesn’t make you cold. It makes you clear.

Ask yourself: “Am I thinking this... or was this thought planted?”

Trust your culture, your gut, but don’t let either blindfold you.

Reality Anchors

Define rules before emotion enters:

“I don’t make financial decisions under pressure.”

“People who care about me respect my boundaries.”

“If it can’t wait 24 hours, it’s probably not real.”

You’re not paranoid; you’re principled.

The Frame Challenge: 3 Tactics to Own the Narrative

It’s not enough to detect manipulation. You need to run your own mental OS.

Here’s your 3-part protocol:

Tactic 1: Reframe in Conversation (The Interruption Drill)

When someone cuts you off, don’t get rattled. Calmly say: “Let me finish that thought—it’s important.” Then pick up exactly where you left off.

No apology. No pause. Just pressure.

Tactic 2: Anchor the Narrative (The Pre-Frame Technique)

Before any interaction, drop a line that sets the tone: “Here’s how I’d like to approach this…” “Let me walk you through something most people miss…”

This forces others to play inside your structure.

Tactic 3: Own the Environment (The Silent Power Test)

Walk into a room. Say nothing. Take your time. Look around. Let others fidget. Then speak; slow, direct. Watch how silence reclaims dominance.

Fraud doesn’t break your brain. It rewrites the operating system your brain runs on. Your only defense is frame awareness. Your only weapon is frame choice.

The person who frames the question controls the answer.

And the one who controls the answer… controls reality.

Now go rewrite it.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

The Sacrificial Lamb: How a Texas Teacher Got Trapped in a Banking Scam Frame

“I had never really felt like I was gonna pass out before… but it felt like the end of the world.” Russell Leahy, Fraud Victim. Credit: KPRC Click2Houston

Meet Russell Leahy.

A newlywed.

A public school teacher.

A loyal saver of money, who avoided nights and weekend frivolous spending

And now, another statistic in the psychological warfare of digital fraud.

Leahy didn’t lose $32,000 because he was stupid.

He lost it because he followed logic inside someone else’s frame.

Let’s break this down.

The Attack Vector

It started like most scams do: urgency + authority.

Russell got a call. A voice said it was Chase Bank. There was “suspicious activity.” He needed to move his funds into a “safe account.”

Seems laughable, right? Until you realize:

The texts were real.

The bank statements looked legit.

The caller ID said Chase.

And the voice? Calm. Helpful. Urgent.

In one move, Russell did what any reasonable, newly married man would do:

He tried to protect his money.

The Frame Hijack

This wasn’t just a scam.

This was a frame war, and Russell lost before the call even ended.

Let’s map it:

Frame 1: "This Is a Threat to Your Security"

Trigger: Fear

Target Behavior: Immediate compliance

Result: No time to verify

Frame 2: "We’re From the Bank—We Can Help You"

Trigger: Authority bias

Target Behavior: Trust transfer

Result: Bypasses suspicion

Frame 3: "Move Your Funds to Safety"

Trigger: Self-preservation

Target Behavior: Action

Result: Voluntary loss

The Fallout

Russell moved $32,000 into the scammer's account.

Gone.

Chase refunded $2,000. The rest? Out of scope. Out of protection. (The bank referred Russell to their disclaimer: "Fraud on a bank account involves someone illegally accessing someone else's account and making withdrawals, transfers, or purchases without the account holder's permission.")

and technically… he authorized the transfer.

Even after realizing what happened, Russell said it felt like a complete identity violation: "I couldn't even believe how sophisticated it was, It was my entire life savings."

He didn’t just lose money.

He lost belief in systems, in people, in himself.

And that’s the deeper con. Not financial. Psychological.

The Dead Drop Read: What You Need to Learn (Fast)

This is not only a feel-bad story. This is a strategic breakdown of psychological warfare. Here's how to avoid becoming the next Russell.

Never Act Inside Their Urgency

If you’re rushed, pressured, or made to feel like something catastrophic is unfolding, stop everything.

No real institution will ever require you to act in minutes.

Hack: Use the 24-Hour Rule. Delay any money movement for one full day. If it’s real, it’ll still be there.

Watch for Frame Layering

Scammers don’t just lie. They layer frames to override logic.

When urgency (fear) meets authority (bank spoof) meets emotional trust (texts, emails, or “help”), your brain short-circuits.

Tactic: Ask yourself, “What if this is theater?”

Don’t respond to the message, analyze the setup.

Anchor in Precommitments

Have ironclad personal rules:

“I never move money over the phone.”

“I hang up and call back using a verified number.”

“I verify with a human at the local branch, no exceptions.”

In times of panic, people don’t rise to the occasion, they fall to the level of their training. So train.

Fraudfather’s Final Assertion

Scams don’t work because we’re gullible. They work because someone else writes the script, and we act it out.

Fraud is psychological stagecraft.

If you don’t claim authorship of the frame, you’re just another character in their story.

We’re not here to shame victims.

We’re here to weaponize the truth before it weaponizes you.

Russell Leahy is brave for speaking out. But he shouldn’t have had to.

Let his $32,000 loss be your early warning system.

Because if you don’t control the frame, the frame controls you.

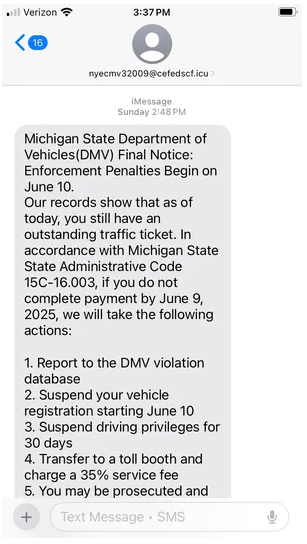

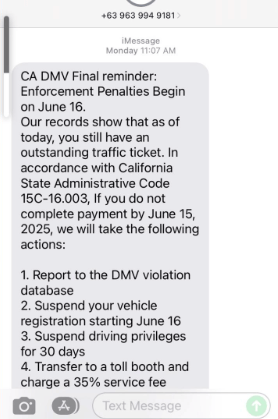

The Toll Scam Text Epidemic

How a Simple SMS is Hijacking Minds Across America, and What You Can Learn No Matter Where You Live

“You have unpaid tolls. Pay now or face license suspension.”

A copy of a fake text sent to a Michigan resident on June 8, 2025

That’s the hook.

It’s not a real threat. It’s a test.

And Americans are failing it by the thousands, daily.

The Setup

Across the U.S., fraudsters are blasting out text messages that look like they come from government agencies.

“Unpaid toll fees detected.”

“Failure to pay will result in additional fines.”

“Click here to settle your balance now.”

The links look official. The tone is urgent. And the framing is surgical:

Fear → Authority → Deadline.

This is a classic smishing attack (SMS phishing).

But more dangerously, it’s a frame hijack.

What’s Really Happening

This isn’t just a U.S. problem.

This is a case study in how modern fraud operates anywhere:

Authority Simulation

The scam impersonates a legitimate institution (DMV, toll agency, etc.). The goal? Trigger obedience.Urgency Pressure

Fake deadlines weaponize your instincts. You stop thinking and you start reacting.Frictionless Compliance

The link is right there. All it takes is a click to enter their world, and hand over yours.

Whether you’re in Colorado, California, Cairo, or Copenhagen, these are universal manipulation levers.

What U.S. Readers Are Seeing

Here’s how this scam is hitting different American regions:

Michigan: Scam texts reference toll roads. Michigan has none. Still, thousands fall for it.

Colorado: DMV spoofing surges. Over 400% increase in fake toll alerts.

California, Alaska, Iowa: Citizens warned not to click fake traffic violation links.

Nationwide: Even in rural areas, fake .gov-looking URLs are flooding inboxes.

Agencies from Alaska to Texas are begging people:

Do not click. Do not respond. Do not pay.

Screenshots taken June 19, 2025, of a text messaging scam alleging to be the state DMV.

What Global Readers Should Know

Even if your country doesn’t use toll texts, this tactic is going global.

Same blueprint. Localized skin.

Watch for:

Fake customs fees

Quarantine fines

Immigration status "updates"

COVID-era emergency payments

Anywhere there’s government authority + citizen compliance, this scam thrives.

Frame = "You're in trouble unless you obey now."

Reality = "You're not. But you will be if you click that link."

Tactical Takeaways

Rule 1: Assume Every Urgent Text is a Lie

Governments and banks don’t operate through random SMS links.

If it demands instant action. It’s trying to control you.

Rule 2: Precommit to Protocol

Write your own rulebook before the scammer writes one for you.

“I never pay bills via text.”

“I confirm through official websites only.”

“I don’t act under pressure—I investigate.”

Rule 3: Teach Your Circle

This isn’t just about protecting yourself.

Send a message to your aging parents, your international contacts, your less tech-savvy friends:

“If anyone texts you saying you owe money, don't click. Call the me or agency directly.”

You’re not just being cautious. You’re being operationally aware.

Final Assertion

A scam text is just the surface.

The real danger is the frame it slips past your defenses.

You’re not battling a link. You’re battling a mental model.

If they control the urgency, they control the action.

Kill the urgency, own the frame.

About The Fraudfather

The Fraudfather combines a unique blend of experiences as a former Senior Special Agent, Supervisory Intelligence Operations Officer, and now a recovering Digital Identity & Cybersecurity Executive, He has dedicated his professional career to understanding and countering financial and digital threats.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former U.S. President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in a pitch-black elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.

📞 Book a Call with the Fraudfather! to fortify your defenses today!

This newsletter is for informational purposes only and promotes ethical and legal practices.